Este artículo también está disponible en español.

In an announcement right now, Japanese agency Metaplanet revealed plans to extend its Bitcoin (BTC) holdings by issuing $11.3 million price of bonds to fund the acquisition.

Metaplanet To Improve BTC Holdings By means of Bond Issuance

The Tokyo-listed firm introduced on November 18 that its Board of Administrators had accredited a debt sale with a assure price 1.75 billion yen, or roughly $11.5 million. The bonds can have a one-year maturity interval, maturing on November 17, 2025, and can carry an rate of interest of 0.36% every year.

Associated Studying

The proceeds from the bond issuance will probably be used solely to buy BTC. It’s price noting that Metaplanet already holds 1,018 BTC on its steadiness sheet.

Sometimes called “Asia’s MicroStrategy,” Metaplanet’s newest BTC acquisition announcement comes only a week after the US-based enterprise intelligence agency MicroStrategy bought 27,200 BTC, price roughly $2.03 billion at present market costs.

Metaplanet started buying BTC as a strategic treasury reserve asset in April. The corporate introduced it was adopting a “Bitcoin-first, Bitcoin-only” strategy, mirroring MicroStrategy’s BTC funding technique.

Since April, the early-stage funding agency has steadily expanded its Bitcoin portfolio. As an example, the corporate acquired an extra 20.195 BTC in June, price roughly $1.2 million.

It added one other 38.464 BTC in September, valued at roughly $2 million. Most lately, in October, the agency introduced it had bought 156.78 BTC, bringing its whole holdings to over 1,000 BTC.

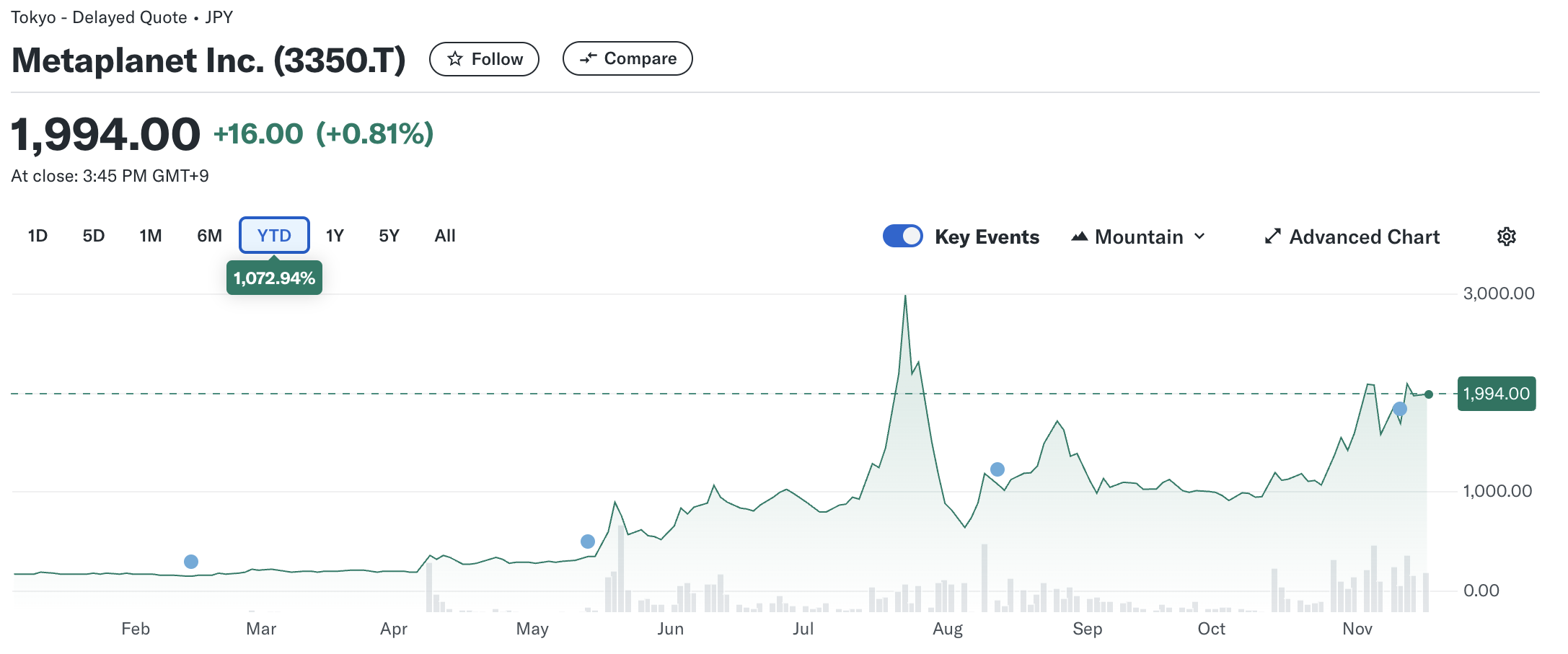

Regardless of the announcement of the bond issuance, Metaplanet’s share value noticed little motion. The agency’s share closed the day with a modest 0.81% enhance on Monday.

Nonetheless, for the reason that firm started its Bitcoin acquisition technique, its inventory has skilled explosive progress. On April 4, 2024, Metaplanet’s shares traded at 190 yen ($1.23). At this time, they commerce at 1,994 yen ($12.86), reflecting good points of practically 950% in simply over seven months.

Bitcoin Provide Shortage To Additional Propel Value?

With rising retail, institutional, and even sovereign demand, Bitcoin’s restricted provide may result in a provide shock, doubtlessly driving the digital asset’s value to unprecedented ranges. As a reminder, BTC’s whole provide is capped at 21 million by design.

Associated Studying

In line with a current evaluation by a CryptoQuant analyst, BTC reserves on cryptocurrency buying and selling platforms have fallen to a five-year low. The analyst additionally famous that extra buyers maintain Bitcoin long-term as a hedge in opposition to rising inflation and forex debasement.

Equally, a current report means that BTC demand vastly exceeds its provide. This rising supply-demand imbalance might set the stage for Bitcoin’s subsequent main value breakout. BTC trades at $90,909 at press time, up 0.1% prior to now 24 hours.

Featured picture from Unsplash, Charts from Yahoo! Finance and Tradingview.com