Este artículo también está disponible en español.

Bitcoin set a brand new all-time excessive yesterday, reaching $93,483, persevering with its spectacular rally with out important setbacks. Over the previous 9 days, the crypto chief has surged with minimal dips, not falling greater than 5% throughout this bullish part. This relentless worth motion has drawn widespread consideration as Bitcoin defies expectations and resists any notable pullback.

Associated Studying

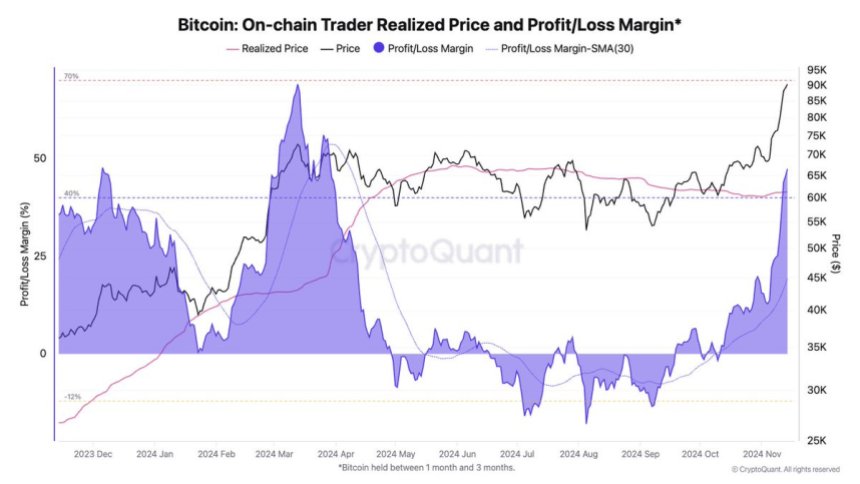

Key knowledge from CryptoQuant reveals that merchants’ unrealized revenue margins are climbing, indicating that the market could also be nearing a short-term peak. Excessive unrealized revenue ranges sometimes sign {that a} correction might be on the horizon as traders look to safe positive factors. Nevertheless, given the present power of Bitcoin’s worth motion, the timing and scale of any correction stay unsure.

With Bitcoin’s worth momentum displaying few indicators of slowing down, the approaching days might be essential in figuring out whether or not the market can maintain these ranges or if a wholesome retrace is in retailer. Buyers are intently anticipating potential entry factors and key help ranges, realizing that even minor dips might set off sturdy shopping for curiosity as Bitcoin’s bullish part persists.

Bitcoin Robust Transfer About To Pause?

Bitcoin’s worth motion has been outstanding, surging 38% for the reason that U.S. election and capturing widespread consideration with its unrelenting bullish momentum. Nevertheless, this aggressive rally could also be approaching a brief pause, as knowledge hints at a possible correction.

CryptoQuant’s head of analysis, Julio Moreno, just lately shared a compelling chart highlighting Bitcoin merchants’ unrealized revenue margins, which have reached 47% — a degree that has typically preceded worth pullbacks.

Excessive unrealized revenue margins can point out that merchants are sitting on important positive factors, elevating the chance of profit-taking that might set off a market cooldown. Moreno’s evaluation notes that this metric tends to correlate with a heightened danger of a correction when it surpasses sure thresholds. As an example, prior peaks in March reached 69%, whereas December 2023 noticed unrealized income hit 48%, each cases that led to notable corrections shortly after.

Nonetheless, the present 47% degree means that, whereas warning could also be warranted, Bitcoin’s bullish part nonetheless has room to run. Previous cycles exhibit that the market has tolerated even larger unrealized income earlier than reversing. The info implies that whereas a pullback could also be on the horizon, Bitcoin might proceed its upward development a bit longer earlier than any important cooling happens.

Associated Studying

Within the coming days, traders might be watching intently for any indicators of a consolidation part or a possible retracement. Ought to Bitcoin keep sturdy help ranges, persevering with this bull run stays believable. Nevertheless, if profit-taking intensifies, a correction might present a wholesome reset for Bitcoin to collect momentum for future positive factors.

BTC Breaking ATH Virtually Each Day

Bitcoin has shattered its all-time excessive seven occasions over the previous eight days, fueling a extremely bullish sentiment throughout the market. At the moment buying and selling at $90,620 after peaking at $93,483, Bitcoin’s worth motion stays sturdy, signaling sustained shopping for momentum. This surge has set a notably optimistic tone, however a short correction interval might present a mandatory reset after such an prolonged upward thrust.

Given the excessive shopping for stress, a short-term pullback to determine a brand new market equilibrium can be a wholesome growth. This might permit Bitcoin to check decrease demand ranges and set up stronger help areas for its subsequent leg up. If profit-taking intensifies within the close to time period, BTC might revisit the $85,000 mark because it seeks to stabilize.

Associated Studying

Within the coming days, traders will probably look ahead to this potential consolidation part to gauge Bitcoin’s resilience. A profitable retest of help round $85,000 would reaffirm confidence within the ongoing bull market, offering a stronger basis for Bitcoin to push towards even larger ranges. Total, whereas the development stays bullish, a balanced correction could also be simply what the market wants to keep up its momentum over the long run.

Featured picture from Dall-E, chart from TradingView