Este artículo también está disponible en español.

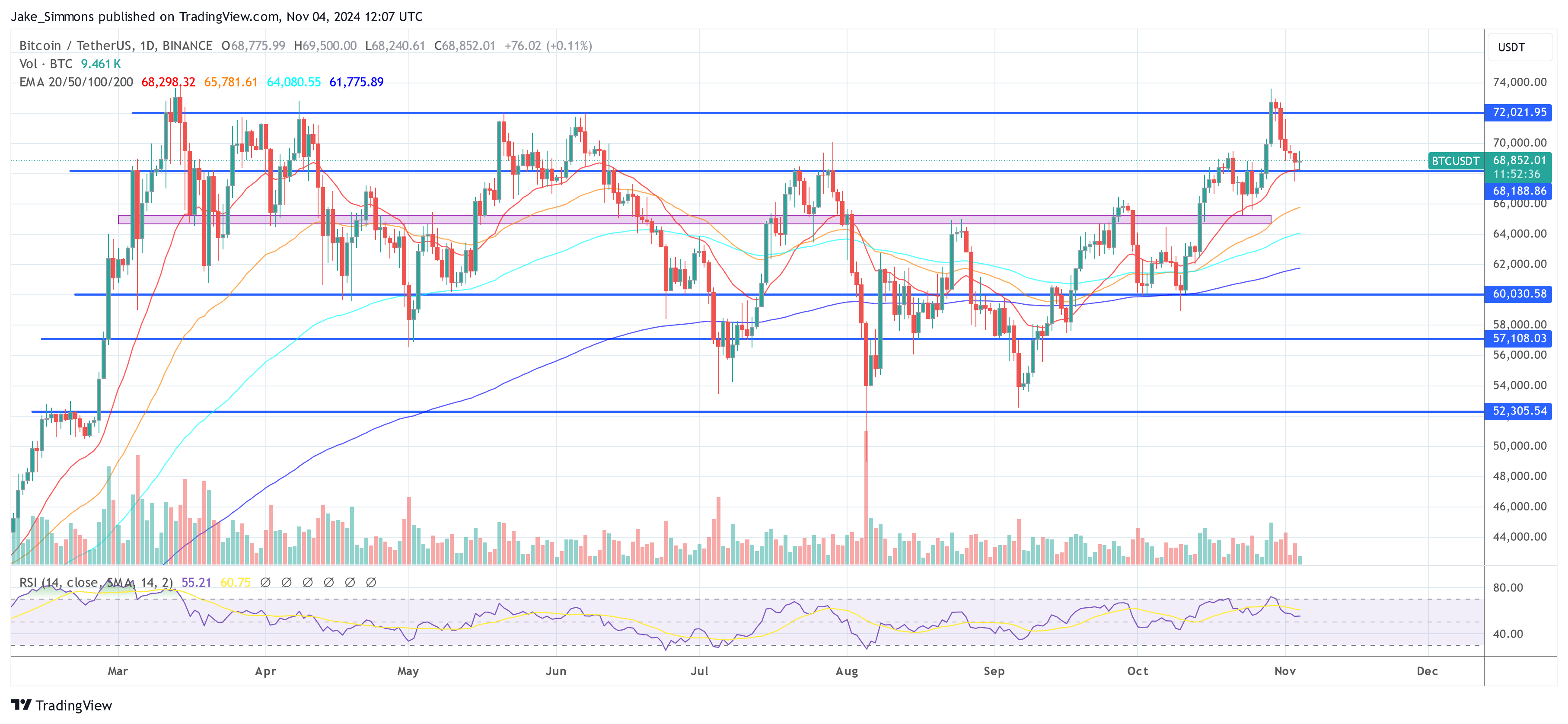

The Bitcoin value has posted 5 consecutive crimson each day candles because it stopped simply in need of its all-time excessive at $73,620 final Tuesday. In consequence, the BTC value has fallen by round 7%. This decline is clear on the weekly chart, which exhibits a serious bearish weekly candle – a headstone doji.

Chartered Market Technician (CMT) Aksel Kibar famous by way of X, “BTCUSD weekly candle can look much like GOLD,” and defined that it signifies a reversal is on the horizon. Nonetheless, he added, “It’s not reliable as a person candle. Greatest to mix it with a following weak candle as a affirmation of development reversal. […] The market narrative is that the bulls try to push to new highs over the session however the bears push the value motion to close the open by the session shut.

Bitcoin To Hit $75,000 By Finish Of November?

Regardless of this, Singapore-based crypto buying and selling agency QCP Capital stays bullish in its newest investor word, highlighting important shifts in each political prediction markets and the BTC derivatives market.

Associated Studying

In keeping with QCP Capital, the chances on the decentralized prediction market Polymarket have “moved nearer to precise ballot estimates,” with Vice President Kamala Harris and former President Donald Trump “locked in a decent race.” Whereas Polymarket nonetheless favors Trump at 55%, this marks a lower from 66% every week in the past, indicating a narrowing margin that aligns extra intently with mainstream polling information.

The agency additionally famous a cautious sentiment prevailing within the cryptocurrency market. The “sideways value motion over the weekend” and a lower in leveraged perpetual futures positioning—from $30 billion to $26 billion throughout exchanges—recommend that merchants are adopting a wait-and-see strategy. This pullback could also be because of uncertainties surrounding macroeconomic components or the upcoming election.

Regardless of the present market hesitancy, QCP Capital sees potential for important upward motion in Bitcoin’s value. The agency questioned whether or not that is “the calm earlier than a break from the multi-month vary and push towards all-time highs.” Supporting this outlook, QCP noticed a rise in topside positioning with substantial shopping for of end-November $75,000 name choices since final Friday. This surge in name choices at that strike value means that merchants are positioning for a considerable rally by the top of November.

Associated Studying

Moreover, the agency highlighted elevated exercise in choices tied to the election date. “Election-date choices positions are additionally rising,” QCP famous, with Friday implied volatility exceeding 87%, at the same time as realized volatility stays at 40%. The elevated implied volatility signifies that choices merchants are anticipating important value swings across the election interval.

Wanting forward, QCP Capital expects Bitcoin’s spot value to stay range-bound till the US election outcomes present extra readability. The agency acknowledged that they “count on spot to cut round this vary till we get extra readability on the election outcomes this week,” including that “a Trump win is more likely to trigger a knee-jerk response increased, and vice versa if Kamala wins.”

At press time, BTC traded at $68,852.

Featured picture created with DALL.E, chart from TradingView.com