Este artículo también está disponible en español.

Bitcoin has skilled a unstable week, with costs oscillating between a neighborhood excessive of $69,500 and a low of $65,000. After weeks of pleasure and upward momentum, the market has cooled off, and BTC is at present consolidating beneath the important $70,000 stage. This consolidation section is essential as merchants assess the subsequent potential transfer for Bitcoin.

Associated Studying

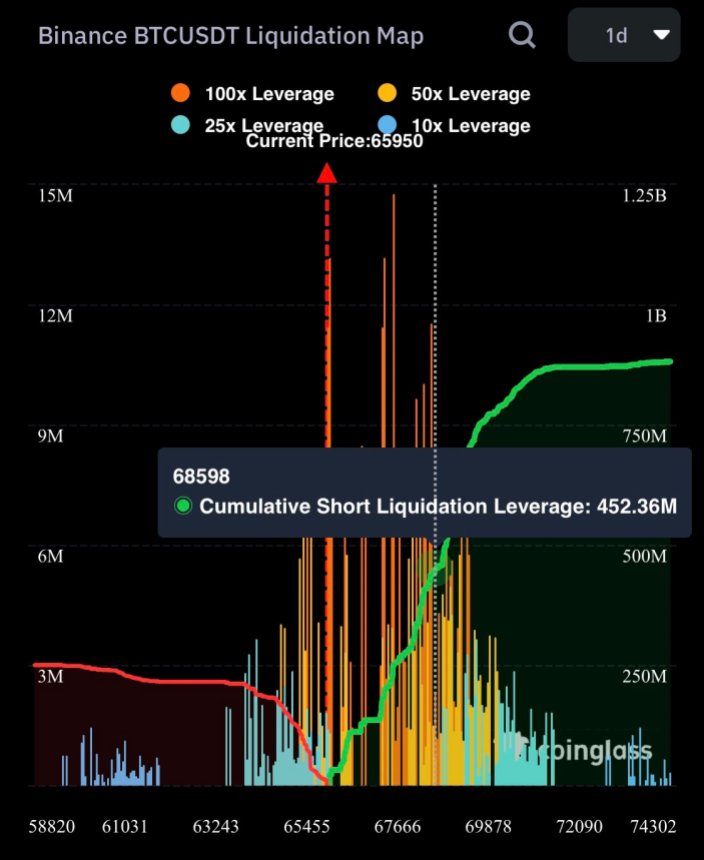

Analyst Ali Martinez has shared vital information from Binance, highlighting the excessive danger for brief positions on the $68,500 mark. When such danger ranges are current, the worth typically seeks liquidity, which means that it could gravitate towards provide zones. This conduct signifies that the market is doubtlessly focusing on areas the place sellers could also be positioned, which may result in additional fluctuations in value.

The interaction between these resistance and assist ranges will decide Bitcoin’s trajectory. A decisive transfer above these ranges may sign Bitcoin’s subsequent section, making it important for buyers to stay vigilant.

Bitcoin Brief Squeeze Looms

Bitcoin is reaching a pivotal second, with the market buzzing with expectations for a possible push towards all-time highs. Martinez lately shared essential information on X, revealing {that a} vital variety of brief positions are prone to liquidation, notably across the $68,598 mark. The cumulative brief liquidation leverage at this value stage is roughly $452.36 million, indicating {that a} substantial quantity of capital might be affected if the worth continues to rise.

This situation units the stage for a bullish outlook, as overleveraged brief positions counsel that Bitcoin may discover liquidity at provide ranges. This might set off a cascade of shopping for stress. When the worth breaks above the important thing $69,000 mark, it may result in a wave of Concern of Lacking Out (FOMO) amongst merchants and buyers watching from the sidelines.

The liquidation of those brief positions may propel Bitcoin’s value greater, strengthening the bullish narrative. Market individuals intently monitor this important threshold, as a decisive break above $69,000 may ignite a surge towards beforehand untested highs.

Associated Studying

Sustaining consciousness of each market dynamics and key value ranges is important for merchants seeking to navigate the volatility. The following few days may show essential as Bitcoin approaches this vital second, and the way it reacts to those overleveraged positions could decide its trajectory within the coming weeks.

BTC Liquidity Ranges

Bitcoin (BTC) is at present buying and selling at $67,100 after per week marked by volatility and uncertainty. The value has pushed above the $66,000 stage, signaling power and hinting at a possible rally within the coming weeks. This upward motion displays renewed optimism available in the market, as buyers search for indicators of sustained bullish momentum.

Nevertheless, it’s important for BTC to take care of its place above the $65,000 mark. If the worth fails to carry this stage, a sideways consolidation could happen, permitting the market to assemble liquidity earlier than making its subsequent transfer. This consolidation section may set the stage for a surge in shopping for exercise as merchants look to capitalize on potential alternatives.

Associated Studying

A break above the important thing $70,000 stage would additional strengthen the bullish outlook, doubtlessly initiating a brand new uptrend. Such a motion may entice extra funding and pleasure available in the market, as merchants and buyers reply to the breakout.

Featured picture from Dall-E, chart from TradingView