Este artículo también está disponible en español.

Bitcoin has rebounded strongly from the $65,000 mark after a 6% dip from Monday’s excessive of round $69,500. Regardless of the latest pullback, BTC stays in a bullish development that has been in place since early September. This rebound reveals resilience, serving to keep the bullish market construction.

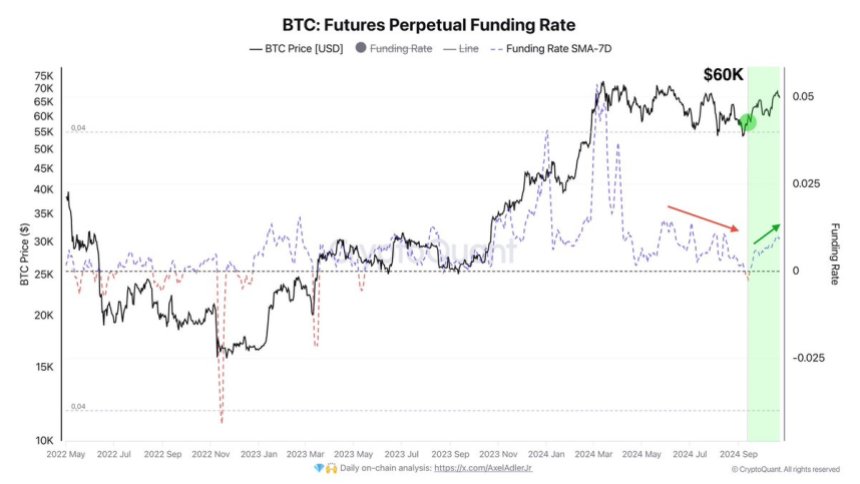

Key knowledge from CryptoQuant reveals that the typical funding fee has steadily grown since September, indicating that bullish sentiment is growing as extra merchants actively interact out there.

Associated Studying

The approaching two weeks shall be pivotal for Bitcoin because it approaches March’s all-time excessive. Traders and analysts intently watch worth actions as BTC builds momentum towards breaking key resistance ranges.

If the bullish development continues, Bitcoin may very well be poised for an additional important rally, with the potential to set new highs shortly. Nonetheless, any failure to carry present ranges might carry renewed volatility.

Bitcoin Exhibiting Energy

Regardless of a latest dip, Bitcoin stays robust above key demand ranges, sustaining the general bullish construction. Analysts and traders are intently monitoring the worth motion for affirmation that the present section is solely a bullish consolidation earlier than the following leg up.

CryptoQuant analyst Axel Adler shared knowledge on X, highlighting the BTC futures perpetual funding fee, which has proven regular progress since Bitcoin reached the $60,000 stage. This means a rising variety of bulls coming into the market, with optimism rising as the worth pushes larger.

Adler advised that bullish momentum will doubtless proceed so long as this funding fee will increase, reinforcing that BTC is in a wholesome consolidation section. Nonetheless, this doesn’t assure an instantaneous breakout. There’s nonetheless a major likelihood that Bitcoin could commerce sideways over the following few days. Sideways worth motion may very well be important for constructing liquidity, permitting the market to collect energy for a bigger transfer.

Associated Studying

Whereas the market sentiment stays optimistic, particularly with the continued enhance in bullish exercise, traders ought to put together for potential fluctuations. The following main worth motion might go in both route, however the regular help above key ranges is a optimistic indicator for these betting on additional upside in Bitcoin’s worth.

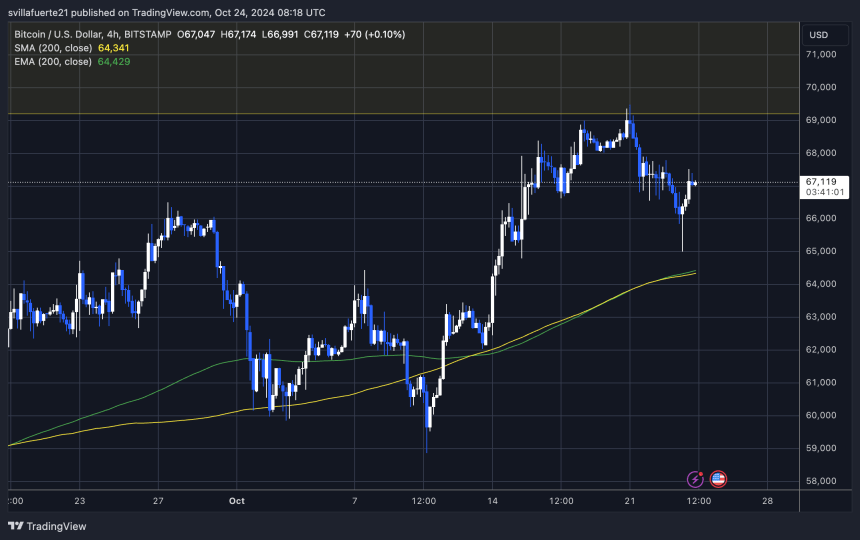

BTC Holding Above Key Demand

Bitcoin is holding robust above the $66,000 stage after discovering help round $65,000. Presently buying and selling at $67,100, the market appears to be in a consolidation section, and it might take a while earlier than a breakout above the essential $70,000 stage.

For the bulls to take care of momentum, it’s important that the worth holds above $65,000 or finds help across the $64,300 mark, the place each the 4-hour exponential shifting common (EMA) and shifting common (MA) align.

Associated Studying

If Bitcoin fails to take care of these help ranges, a deeper correction may very well be anticipated, with the worth probably retracing to decrease demand zones round $60,000. However, if BTC manages to interrupt and maintain above $70,000 within the coming days, this might set off a robust rally towards difficult all-time highs.

With traders intently monitoring key help and resistance ranges, the following few days shall be essential for figuring out Bitcoin’s route.

Featured picture from Dall-E, chart from TradingView