Este artículo también está disponible en español.

Bernstein Analysis, the esteemed analysis arm of world asset supervisor AllianceBernstein, is projecting that Bitcoin will attain $200,000 by the top of 2025. The agency, which manages property value $791 billion as of August 2024, labels this prediction as “conservative” in its newest 160-page “Black Ebook” on Bitcoin.

Why BTC Worth Will Hit $200,000 In 2025

Bernstein’s report, titled “From Coin to Computing: The Bitcoin Investing Information,” delves into the multifaceted dynamics propelling Bitcoin’s ascent. The agency underscores the surge in institutional adoption, the burgeoning marketplace for Bitcoin exchange-traded funds (ETFs), and the evolving position of Bitcoin miners in each the cryptocurrency and synthetic intelligence (AI) sectors.

“If you’re a Bitcoin skeptic … perhaps a restricted provide, ‘retailer of worth’ digital asset is just not such a foul factor in a world the place U.S. debt hits new information ($35 trillion now) and threats of inflation nonetheless loom. Should you like gold right here, it’s best to love Bitcoin much more,” writes Gautam Chhugani, Managing Director and Senior Analyst at Bernstein.

Associated Studying

The report highlights a major shift in institutional funding patterns. In accordance with Bernstein, international asset managers now maintain roughly $60 billion value of Bitcoin and Ethereum ETFs, a fivefold improve from $12 billion in September 2022. The agency describes the launch of those ETFs as “essentially the most profitable within the historical past of exchange-traded funds,” noting $18.5 billion in inflows year-to-date since their introduction in January.

“By 2024 finish, we anticipate Wall Avenue to exchange Satoshi as the highest Bitcoin pockets,” the report states. Bernstein attributes this surge to the logistical challenges of self-custody for retail traders. “With institutional gamers flocking to Bitcoin, ETFs are proving to be the entry level for large-scale funding in digital property,” the agency notes.

Bernstein’s bullish stance on Bitcoin is underpinned by its evaluation of market tendencies and institutional habits. BTC value has already appreciated by 120% over the previous 12 months, with its market capitalization swelling to $1.3 trillion.

“With institutional adoption accelerating, we anticipate Bitcoin to triple from its present ranges,” Bernstein tasks. The agency anticipates that Bitcoin’s market cap might increase to over $3 trillion by the top of 2025, pushed by elevated allocations from wealth administration platforms, pension funds, and registered funding advisors.

The report additionally means that bigger monetary establishments will play a extra dominant position because the market matures. “This new institutional period, in our view, might push Bitcoin to a excessive of $200,000 by 2025 finish,” the analysts write, emphasizing that the forecast is “conservative” given the present trajectory of institutional involvement.

Bitcoin Treasury And Mining

One other focus of Bernstein’s report is the rising adoption of Bitcoin as a company treasury asset. The agency highlights MicroStrategy Included (NASDAQ: MSTR) as a pioneering instance. Led by CEO Michael Saylor, MicroStrategy has allotted greater than 99% of its money holdings to Bitcoin, proudly owning roughly 1.3% of the overall Bitcoin provide.

Associated Studying

“We view MicroStrategy as an lively leveraged Bitcoin fairness technique,” Bernstein states, stating that the corporate’s inventory has provided superior returns in comparison with holding Bitcoin instantly or by way of ETFs.

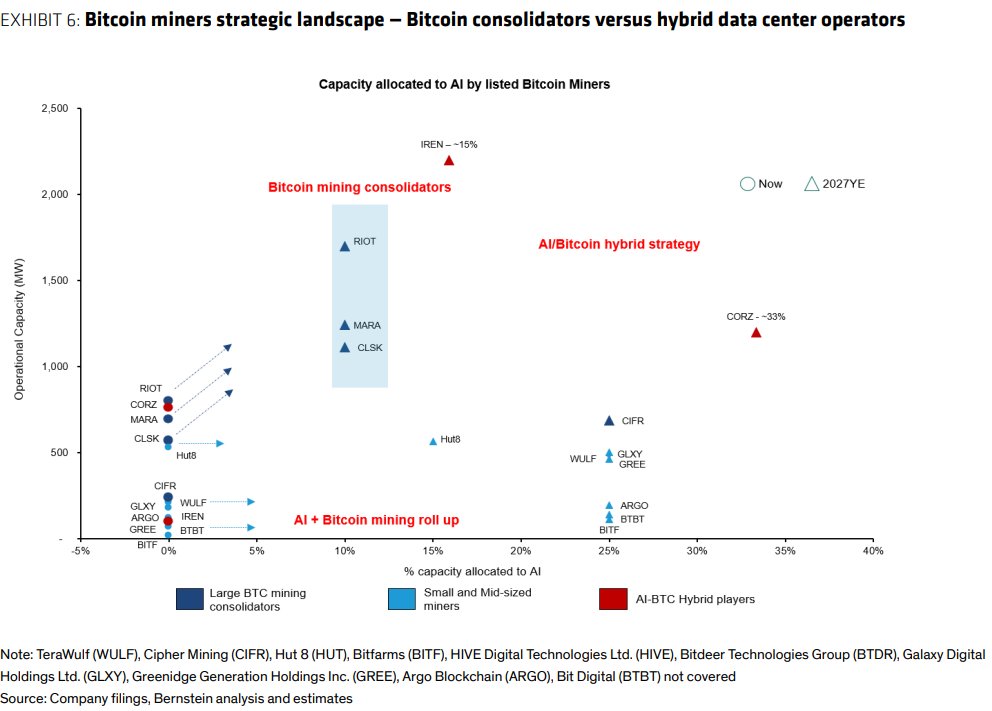

Bernstein’s report additionally sheds mild on the consolidation tendencies throughout the Bitcoin mining business. Main gamers like Riot Platforms (NASDAQ: RIOT), CleanSpark (NASDAQ: CLSK), and Marathon Digital Holdings are buying smaller miners, resulting in an business dominated by industrial-scale operations.

“Main US Bitcoin miners are consolidating share and turning into vitality infrastructure gamers,” the report notes. “We anticipate Riot, CleanSpark, and Marathon to consolidate the Bitcoin mining business.” Bernstein predicts that these main miners will management 30% of Bitcoin’s whole hashrate by 2025.

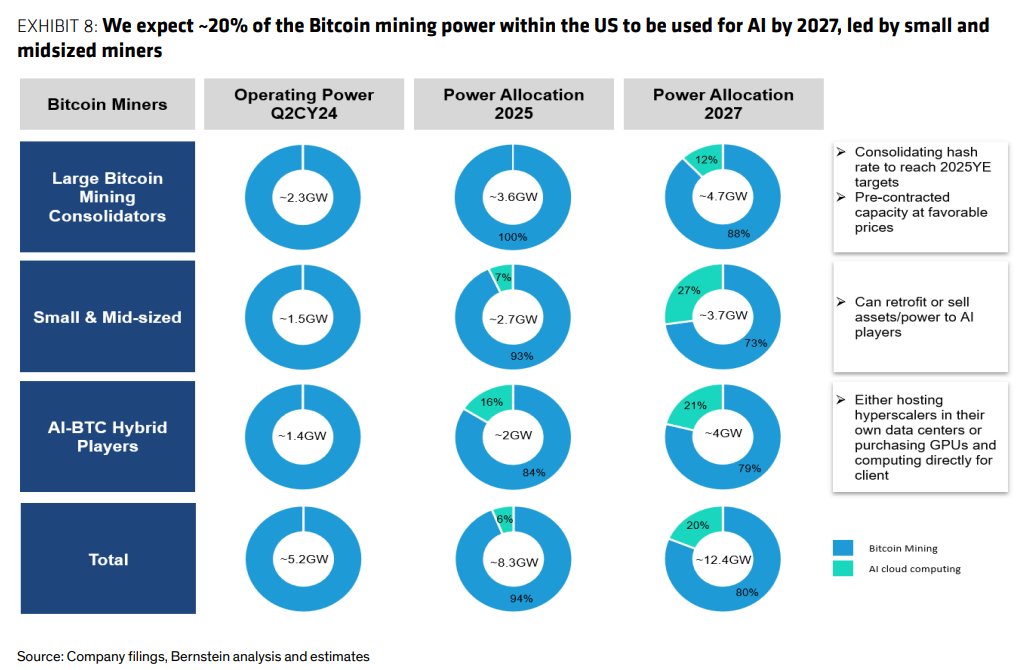

The analysts additional discover the synergy between Bitcoin mining and AI infrastructure. Bitcoin miners are rising as enticing companions for GPU cloud suppliers, providing gigawatt-scale vitality entry and lowering the “time to market” for energizing AI knowledge facilities.

“Miners current an vitality arbitrage alternative, buying and selling at $2-4 million per megawatt, in comparison with $30-50 million per megawatt for legacy knowledge facilities,” Bernstein observes. Firms like Core Scientific and Iris Vitality are capitalizing on this by growing AI knowledge facilities alongside Bitcoin mining operations.

“Bitcoin miners are evolving into important companions for AI knowledge facilities as they capitalize on extra vitality capability and provide environment friendly options for high-performance computing,” Bernstein states. This convergence not solely diversifies income streams for miners but additionally enhances the sustainability and scalability of AI infrastructures.

At press time, BTC traded at $67,162.

Featured picture created with DALL.E, chart from TradingView.com