Este artículo también está disponible en español.

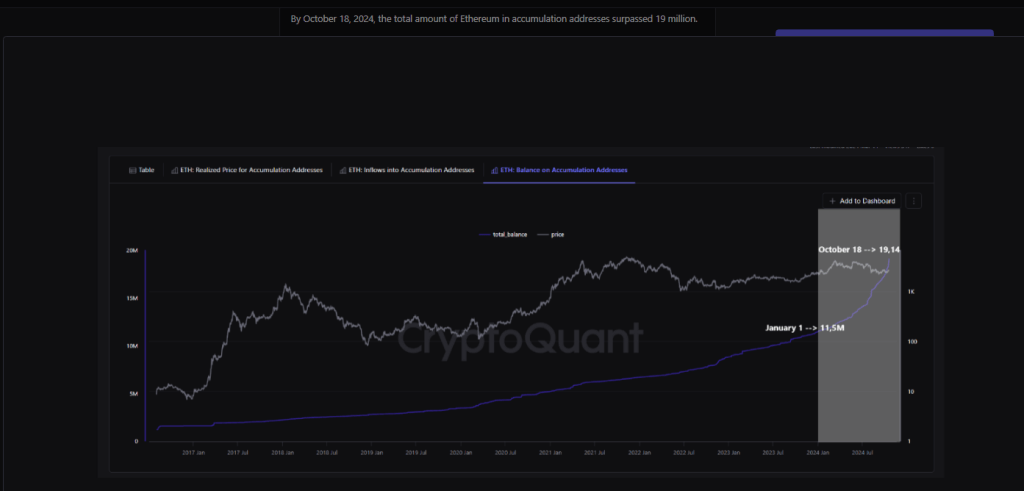

With a formidable enhance in coin acquisition, Ethereum aficionados are inflicting waves within the crypto area. From January’s 11.5 million, the latest statistics reveal a stable 19 million ETH now stashed in long-term holding addresses, nearly doubled, knowledge from CryptoQuant reveals.

With buyers apparently growing their bets, this large surge factors to a rising religion in Ethereum’s future. The crypto world is rife with conjecture since many estimate this rely will attain 20 million by 12 months’s finish.

Associated Studying

Clearly, there’s a vital optimism in Ethereum’s long-term potential regardless of market swings, which leaves many questioning what’s behind this enhance in confidence and what this might imply for the scene of cryptocurrencies going ahead.

Plenty of components are encouraging institutional and particular person buyers to extend their holdings. Notably, the US Securities and Alternate Fee’s (SEC) approval of spot Ethereum exchange-traded funds (ETFs) has allowed new gamers to enter the market.

Spot ETFs Push Demand

Extra curiosity from mainstream buyers has come from Ethereum spot ETF approval in nice half. This means that each particular person buyers and establishments are preparing for Ethereum’s long-term future. One researcher of cryptocurrencies even thinks that by the tip of 2024, the ETH in accumulating addresses will equal the market worth of the most important corporations worldwide.

Moreover, assuming Ethereum costs stay round $4,000, the analyst initiatives that if these patterns proceed, the entire worth of ETH held in these addresses could attain $80 billion. At $2,737 proper now, ETH has elevated in worth by over 3% over the past 24 hours and over 10% over the past week.

Staking Secures Extra Ethereum

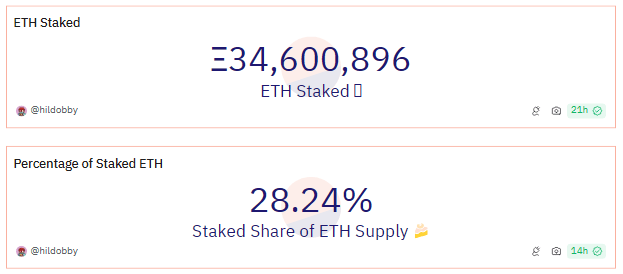

The opposite predominant purpose why much less ETH is discovered available in the market to commerce is thru the rise in Ethereum staking. In response to Dune Analytics, staking contracts have locked up over 34.6 million ETH that equates to almost 30% of your entire Ethereum provide, therefore displaying the statistics. This led to a scarcity of tokens on the market and due to this fact performed a component in taming costs.

Extra worth development for ETH could also be potential if the quantity staked retains growing. The Ethereum market could expertise much less volatility and extra long-term development potential if there are much less sell-side pressures.

Associated Studying

The Value Outlook Is Good

The present worth swings of Ethereum are primarily upward. ETH is at the moment buying and selling above $2,700—a vital assist stage—because of the assist of its 50-day shifting common. The 200-day shifting common, which is $3,022, stays a barrier, although. If Ethereum is to expertise constant worth development, it will likely be crucial to interrupt over that impediment.

Ethereum’s long-term supporters are undoubtedly upbeat concerning the platform’s future, and the accumulating tendency together with staking and spot ETFs recommend that this confidence may not be unfounded. Will probably be attention-grabbing to see if Ethereum can overcome vital pricing obstacles, however one factor is definite: in the intervening time, the long-term image seems promising.

Featured picture from Pexels, chart from TradingView