Este artículo también está disponible en español.

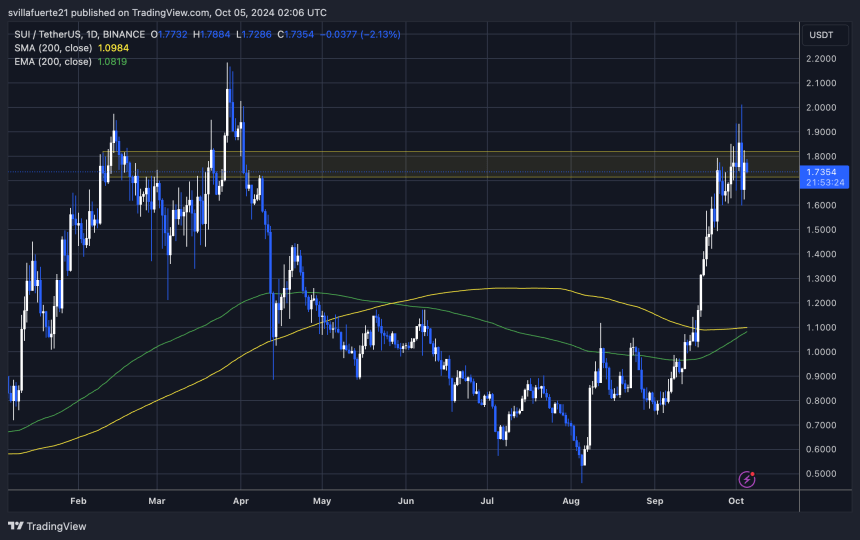

SUI is at the moment testing an important provide zone following a large 95% surge triggered by the Federal Reserve’s current rate of interest reduce announcement. The explosive rally, pushed by important shopping for stress, has led to risky value motion, elevating questions on whether or not this upward momentum will be sustained.

As SUI hovers close to its present highs, market hypothesis is rising round the opportunity of a correction to decrease demand ranges, with $1.40 being the important thing goal.

Associated Studying

Key information from Coinglass reveals a decline in market demand, signaling a possible slowdown in shopping for exercise. This has left some traders on edge, as they anticipate a value drop within the coming days. The sudden surge has fueled each optimism and warning as merchants weigh the potential for continued positive aspects in opposition to the danger of a pointy reversal.

With SUI now at a crucial juncture, the subsequent few days will probably be pivotal in figuring out whether or not the bullish pattern can proceed or if the market will retrace to extra secure demand ranges. Buyers are watching carefully, prepared to regulate their methods based mostly on the unfolding value motion.

SUI Funding Fee Indicators Worth Drop

SUI is at a crucial level after days of utmost value motion and important positive aspects. Following its spectacular 95% rally because the Federal Reserve’s rate of interest reduce announcement, some traders and merchants are starting to take earnings, signaling a possible shift in market sentiment. Many now view a correction to $1.40 as inevitable, particularly as shopping for stress cools down.

Key information from Coinglass suggests a cooling demand, with the funding charge turning unfavorable to -0.067, marking a yearly low. The funding charge is a key indicator in futures buying and selling, representing the periodic fee between merchants in lengthy positions (betting on value will increase) and people in brief positions (betting on value declines).

When an asset’s funding charge turns unfavorable, it signifies that extra merchants are opening brief positions, anticipating a drop in value. This shift displays rising warning out there as merchants begin positioning themselves for a possible downturn.

Associated Studying

With the funding charge at such a low and demand waning, the market is exhibiting indicators of cooling off after SUI’s explosive September rally. Consequently, traders and merchants are actually patiently ready for a correction to decrease demand ranges round $1.40, which may current new shopping for alternatives or sign additional declines relying on the broader market situations.

Key Ranges To Watch

SUI is at the moment buying and selling at $1.73 after experiencing days of risky value motion. The value surged however halted on the essential $2 resistance degree and has since entered a consolidation part slightly below it. This key degree has change into a barrier for bulls, and a push above $2 is important for SUI to regain momentum and ensure a bullish pattern.

Nevertheless, the market stays unsure, and if the value fails to carry the $1.60 help degree, a deeper correction may observe. Analysts predict {that a} break beneath $1.60 could result in a 20% drop, bringing SUI right down to the $1.40 demand zone. This degree is being carefully monitored by traders and merchants as a crucial help to forestall additional draw back stress.

Associated Studying

Because the market fluctuates, SUI’s value motion stays in a fragile steadiness between potential restoration and additional correction. The subsequent strikes round these key ranges will probably decide whether or not bulls regain management or if bears proceed to push costs decrease within the coming days.

Featured picture from Dall-E, chart from TradingView