Este artículo también está disponible en español.

Solana (SOL) is at the moment buying and selling close to a essential assist zone at $145, following a 26% surge for the reason that Federal Reserve introduced rate of interest cuts on September 18. After this sharp rise, SOL skilled a slight 10% dip, however the total market sentiment stays optimistic.

Many analysts and buyers hope Solana will attain new all-time highs by the tip of the 12 months, pushed by optimistic macroeconomic developments and the rising confidence within the crypto market.

Associated Studying

Key knowledge from Coinglass reveals a rising funding price, which signifies growing bullish sentiment amongst merchants. This implies that the current value correction would possibly solely be a brief pause earlier than one other leg greater.

Traders are carefully monitoring SOL’s value motion, with expectations {that a} sustained break above $150 may pave the best way for a brand new rally towards uncharted territory. All eyes at the moment are on Solana because it navigates this important assist degree, with each short-term merchants and long-term holders anticipating a optimistic outlook within the coming weeks.

Solana Is Making ready For A Rally

Solana (SOL) is at the moment holding agency above a vital assist degree following a small dip that affected the complete market yesterday. Regardless of this minor setback, the sentiment amongst buyers and merchants stays overwhelmingly optimistic. Many anticipate SOL to rally and surpass multi-month highs, given the current power in its value motion.

Key knowledge from Coinglass highlights that Solana’s funding price has been on an upward pattern since mid-September. Yesterday, it reached 0.0127%, the very best degree since late July. A rising funding price is usually a bullish indicator, signaling rising demand for a token.

The funding price is a mechanism utilized in perpetual futures contracts, the place it may be both optimistic or unfavourable. It adjusts based mostly on the worth distinction between the perpetual contract and the spot value, together with rates of interest. When the funding price is optimistic, patrons (longs) are paying sellers (shorts), which inspires futures and spot costs to converge.

Associated Studying

This rising funding price for SOL means that extra merchants are betting on the token’s future appreciation, anticipating greater costs within the coming weeks. With Solana sustaining its present assist and displaying sturdy market fundamentals, the potential for a major rally stays excessive. Traders at the moment are watching carefully to see if Solana can break by means of its subsequent resistance ranges and make sure the beginning of a brand new bullish section.

SOL Testing Demand

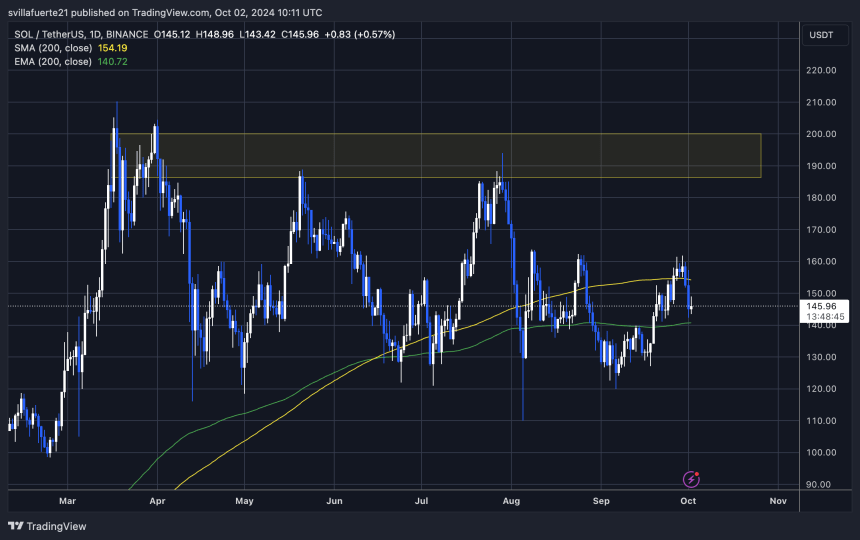

Solana (SOL) is at the moment buying and selling at $145, holding sturdy above the day by day 200 exponential shifting common (EMA) at a essential assist degree of $140. This key space has confirmed to be a strong basis for the worth, and if bulls wish to ignite an upward rally, they have to defend this assist zone. For momentum to shift decisively upward, SOL wants to interrupt previous the day by day 200 shifting common (MA), which sits at $154.

A detailed above the 200 MA would doubtless set off a bullish rally, doubtlessly pushing the worth towards greater targets. Nonetheless, failure to keep up this key assist and shut above these ranges may end in prolonged sideways consolidation or, worse, a deeper correction. In such a situation, the subsequent demand zone can be round $110, a major assist degree that might appeal to patrons if the market enters a bearish section.

Associated Studying

For now, the $140 assist degree stays the road within the sand for Solana’s value motion. Merchants are carefully monitoring whether or not SOL can break by means of key resistance ranges and proceed its ascent, or if a possible correction is on the horizon.

Featured picture from Dall-E, chart from TradingView