Matthew Sigel, Head of Digital Property Analysis at VanEck, has highlighted the numerous potential for development in Bitcoin’s derivatives market.

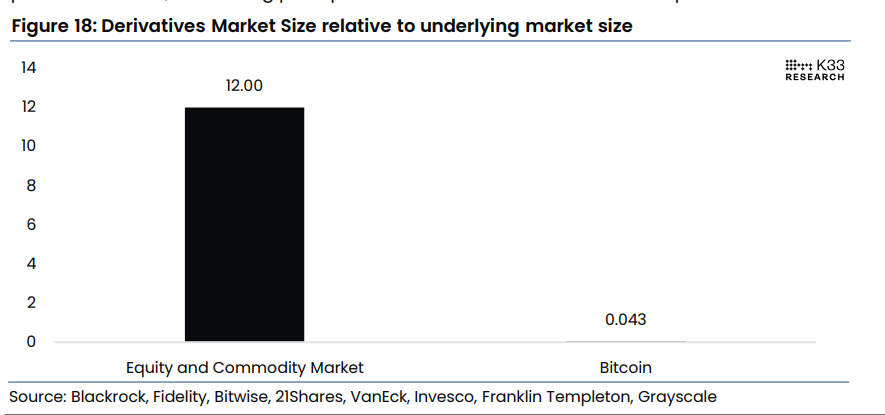

In a current put up, he famous that fairness and commodity derivatives are 279 instances bigger than Bitcoin’s relative to their underlying markets. A chart he shared confirmed that whereas fairness and commodity derivatives are 12 instances the dimensions of their underlying markets, Bitcoin’s derivatives are solely 4.3% of its personal.

The US Securities and Alternate Fee’s approval of choices buying and selling for BlackRock’s iShares Bitcoin Belief (IBIT) might catalyze this development. IBIT ranks among the many most liquid ETFs within the nation, and the introduction of choices buying and selling is predicted to attract extra liquidity and institutional buyers to Bitcoin.

As of September 2024, the Bitcoin derivatives market has grown however stays modest in comparison with conventional markets. Month-to-month crypto derivatives volumes have surpassed spot markets, reaching $1.33 trillion. Bitcoin and Ethereum are probably the most ceaselessly referenced property in crypto derivatives.

Regulatory acceptance is growing, signaling better legitimacy for Bitcoin in conventional finance. New merchandise like bodily settled choices and non-deliverable forwards point out ongoing innovation within the sector.

The substantial hole between Bitcoin’s derivatives market and people of conventional property suggests important room for growth. Institutional adoption and market maturation are anticipated to drive development, positioning Bitcoin derivatives to doubtlessly meet up with their standard counterparts.