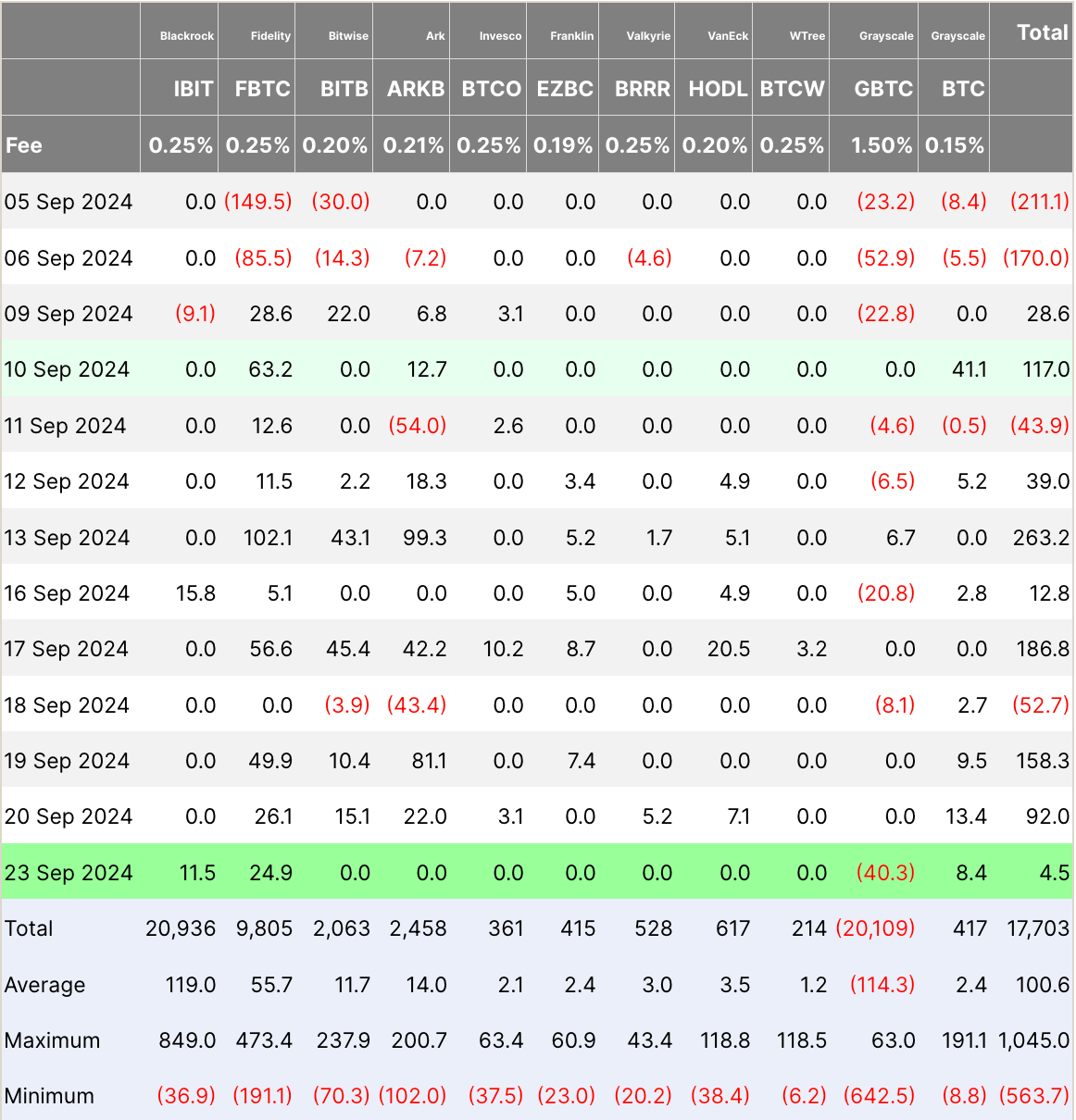

On Sep. 23, Bitcoin ETFs noticed blended flows, totaling $4.5 million. Constancy’s FBTC ETF led inflows with $24.9 million, adopted by BlackRock’s IBIT with $11.5 million. Grayscale’s smaller BTC fund additionally added $8.4 million. Nonetheless, this was offset by vital outflows of $40.3 million from Grayscale’s GBTC, which stays one of many largest Bitcoin ETFs out there. Different main funds, together with Bitwise’s BITB, Ark’s ARKB, Invesco’s BTCO, and others, confirmed no exercise, with flows remaining flat.

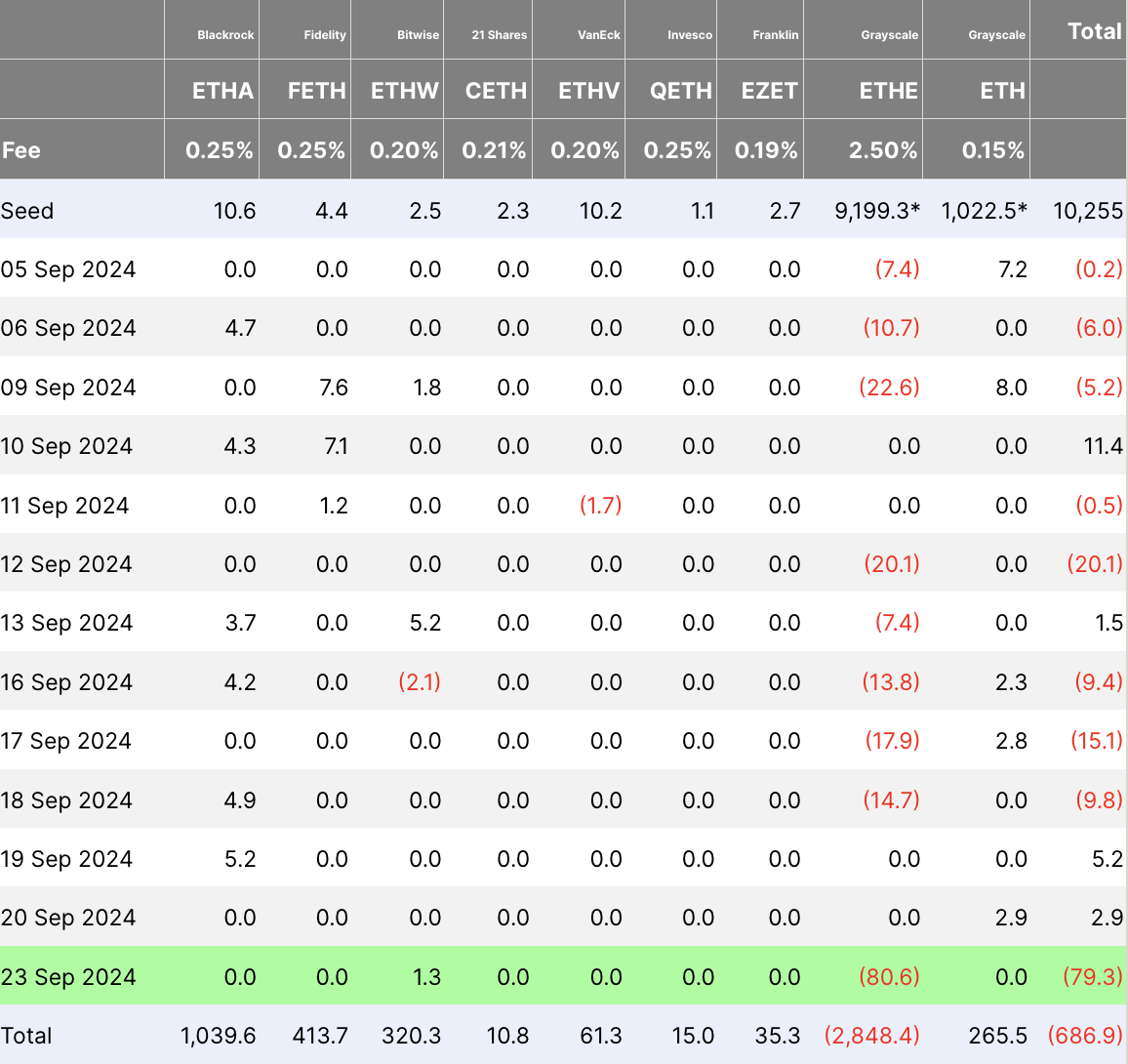

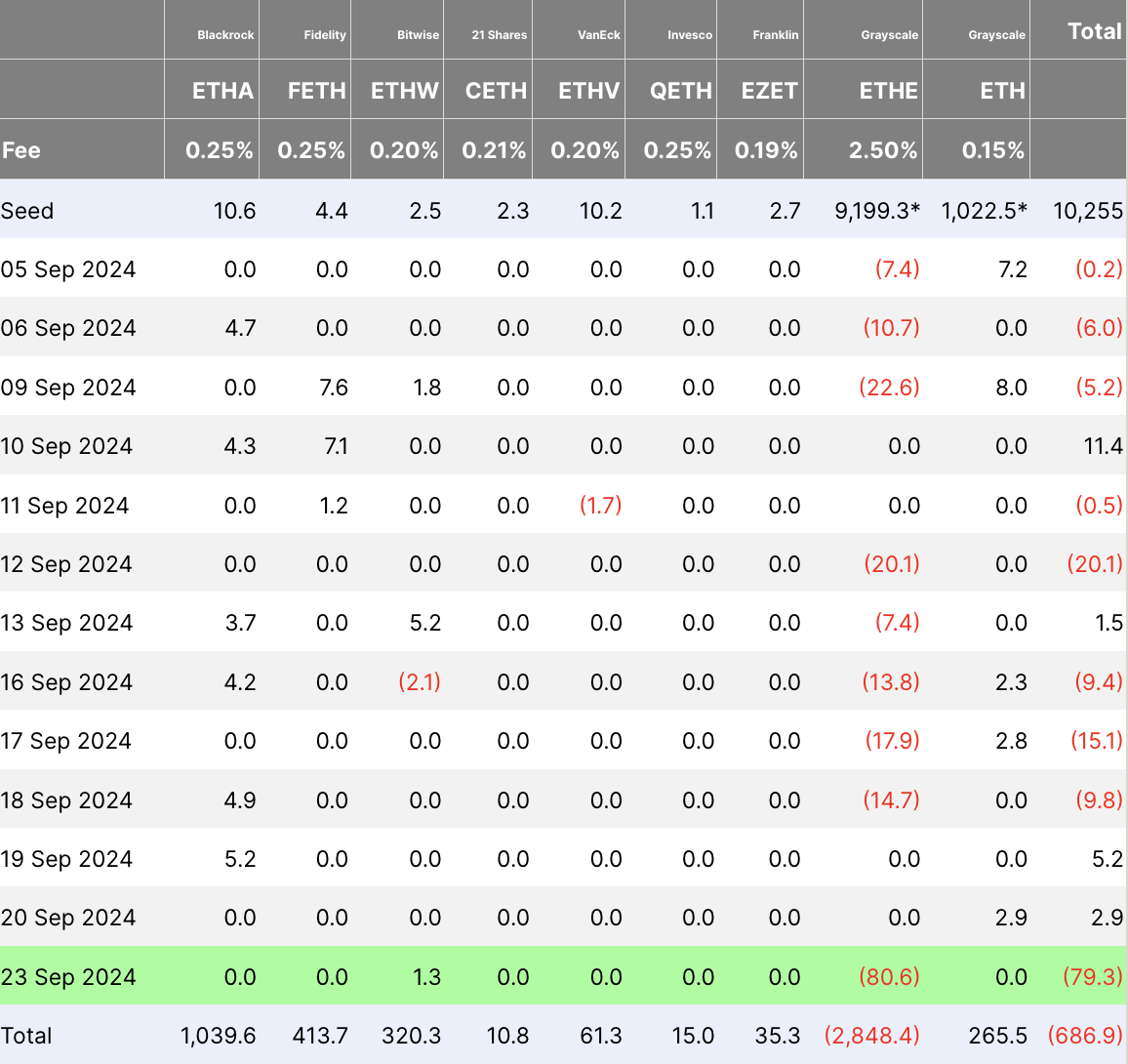

Ethereum ETFs skilled substantial internet outflows, totaling a unfavorable $79.3 million. Grayscale’s ETHE fund drove the majority of the motion with vital outflows of $80.6 million, marking a pointy shift in investor sentiment. Bitwise’s ETHW was the one fund with inflows, recording $1.3 million, whereas all different Ethereum ETFs, together with these from BlackRock, Constancy, 21Shares, VanEck, Invesco, and Franklin, reported no inflows or outflows.

The contrasting flows highlight ongoing volatility and selective investor participation. Bitcoin ETFs noticed pockets of demand, whereas Ethereum ETFs, notably Grayscale’s, confronted pronounced withdrawals.