Fast Take

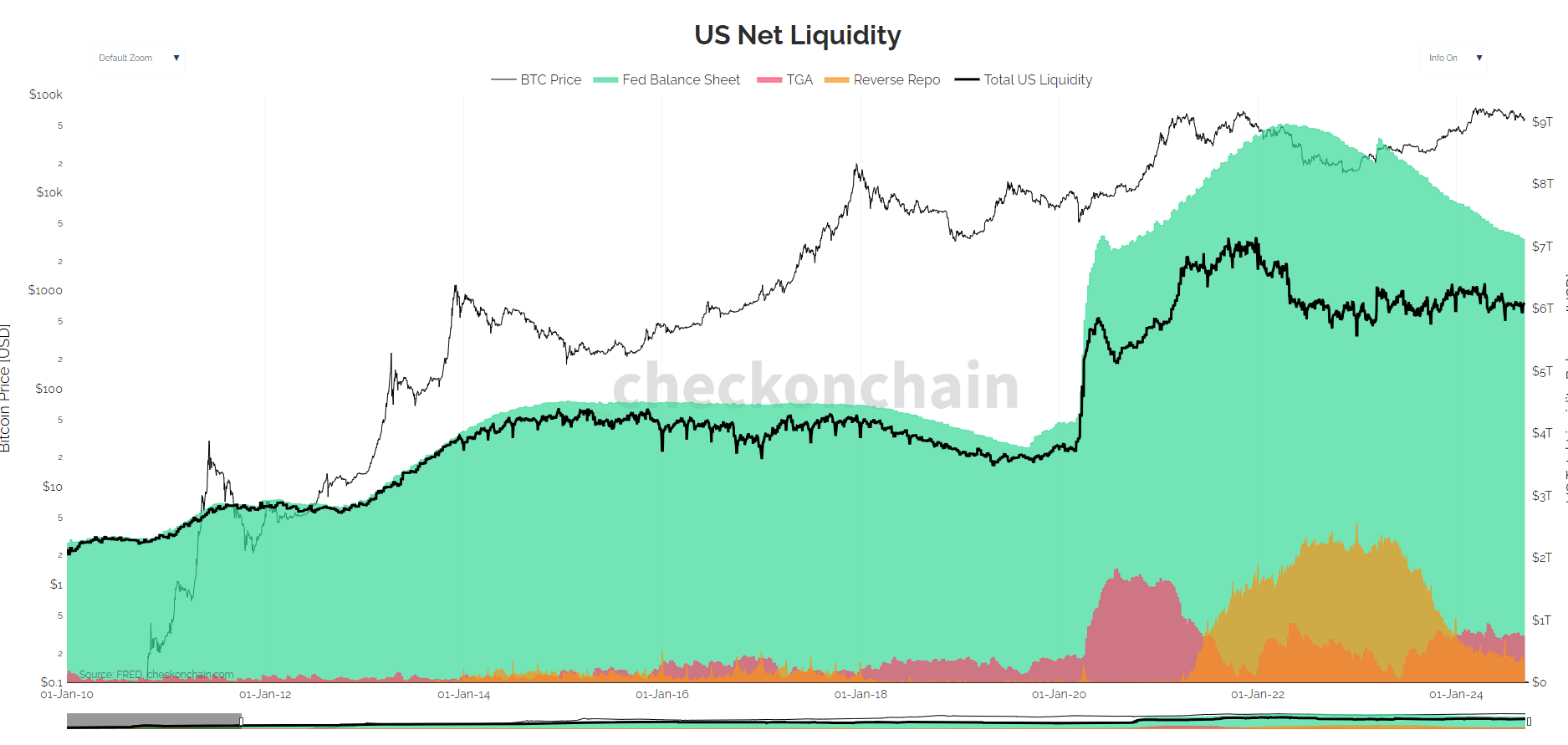

US internet liquidity, which displays the general liquidity situations in monetary markets, will be measured by key parts: the Federal Reserve stability sheet, the Treasury Common Account (TGA), and the Reverse Repo (RRP) facility.

The Fed’s stability sheet represents the belongings the Federal Reserve holds, primarily Treasury and mortgage-backed securities, which, when expanded, inject liquidity into the market. Conversely, the TGA is the US Treasury’s money stability on the Fed; when it’s excessive, it absorbs liquidity from the market, and when it’s low, it provides liquidity.

The Reverse Repo facility is a short-term borrowing association during which monetary establishments lend money to the Fed, quickly draining liquidity from the system. Collectively, these three components drive modifications in internet liquidity within the monetary system.

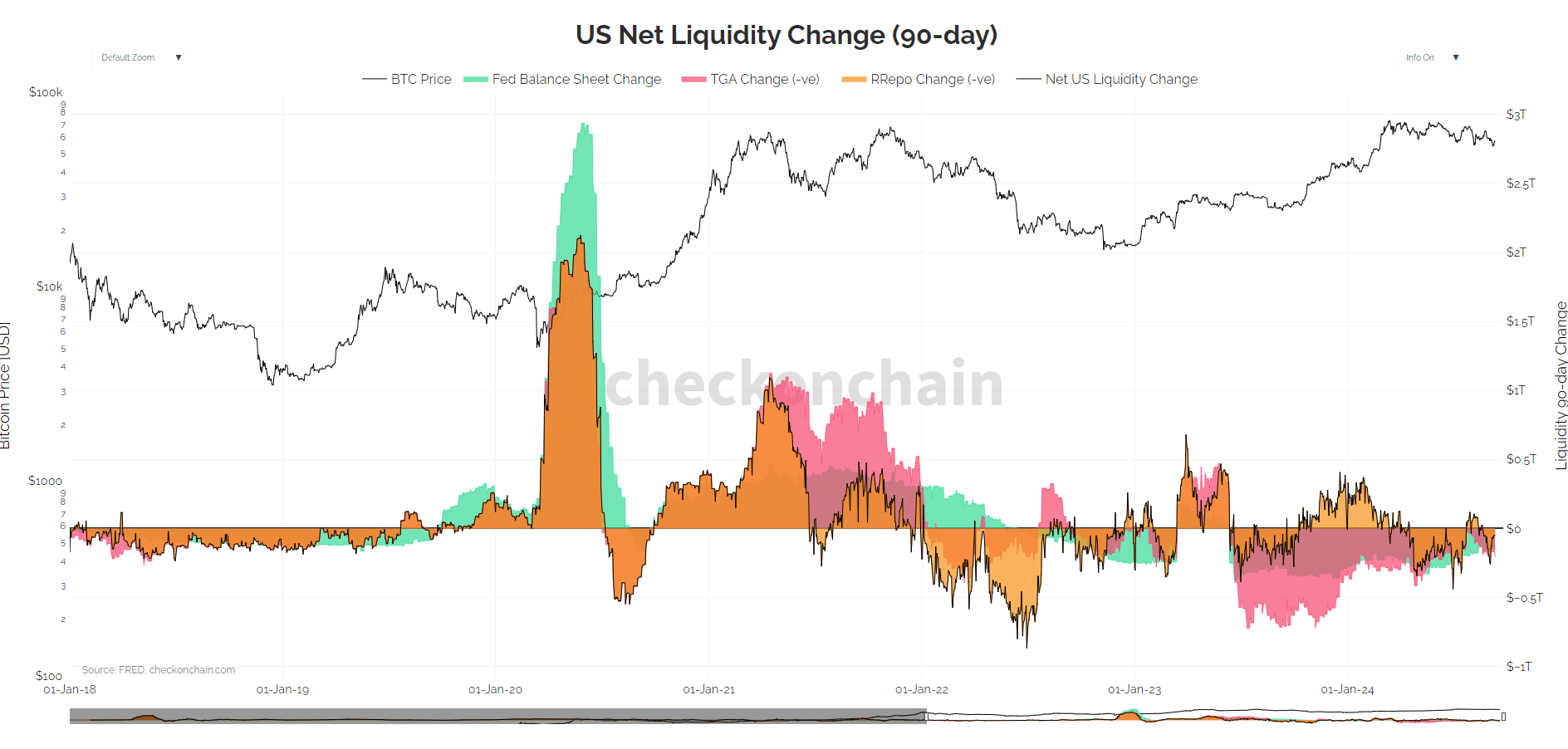

The charts illustrate the 90-day internet liquidity modifications and the long-term pattern. The inexperienced shading represents the Fed stability sheet growth, whereas the purple and orange areas symbolize TGA and reverse repo actions. Web liquidity performs a major position in market efficiency. Bitcoin’s value (proven in black) seems to correlate with elevated or lowered liquidity durations, particularly throughout sharp modifications like these seen throughout the COVID-19 pandemic response and subsequent financial tightening phases.

Since Bitcoin reached its all-time excessive of over $70,000 in March, amid round $6 trillion in US internet liquidity, the value has primarily adopted a sideways/downward pattern. Presently, the Reverse Repo (RRP) facility stands at $300 billion, the bottom stage since mid-2021, whereas the Treasury Common Account (TGA) has remained comparatively flat over the previous yr, staying below $800 billion.

For Bitcoin to start trending increased, a number of liquidity situations must shift. Ideally, the Federal Reserve would wish to reinitiate quantitative easing (QE), which might broaden the Fed’s stability sheet and inject extra liquidity into the market. Moreover, a continued decline within the TGA would unlock extra cash for circulation. Lastly, the Reverse Repo (RRP) facility would wish to stabilize reasonably than proceed declining, which might stop additional liquidity drains. These components mixed might improve whole US liquidity, making a extra favorable atmosphere for Bitcoin and different danger belongings to maneuver increased.

The publish US internet liquidity indicators vital juncture for Bitcoin’s path ahead appeared first on CryptoSlate.