Este artículo también está disponible en español.

Ethereum co-founder Vitalik Buterin has been within the information of late along with his 760 ETH withdrawal–a transfer that raised eyebrows as speculations about what such exterior pockets transactions by him may do to the Ethereum market.

Associated Studying

Transactions are a part of a broader development that has seen wallets related to Buterin and the Ethereum Basis actively promote giant parts of Ether. It’s this aggressive promoting that has added to the bearish stress on Ethereum’s worth, which these days slipped to the low $2,150 stage earlier than recovering barely.

Vitalik Buterin: Particulars Of The Withdrawal

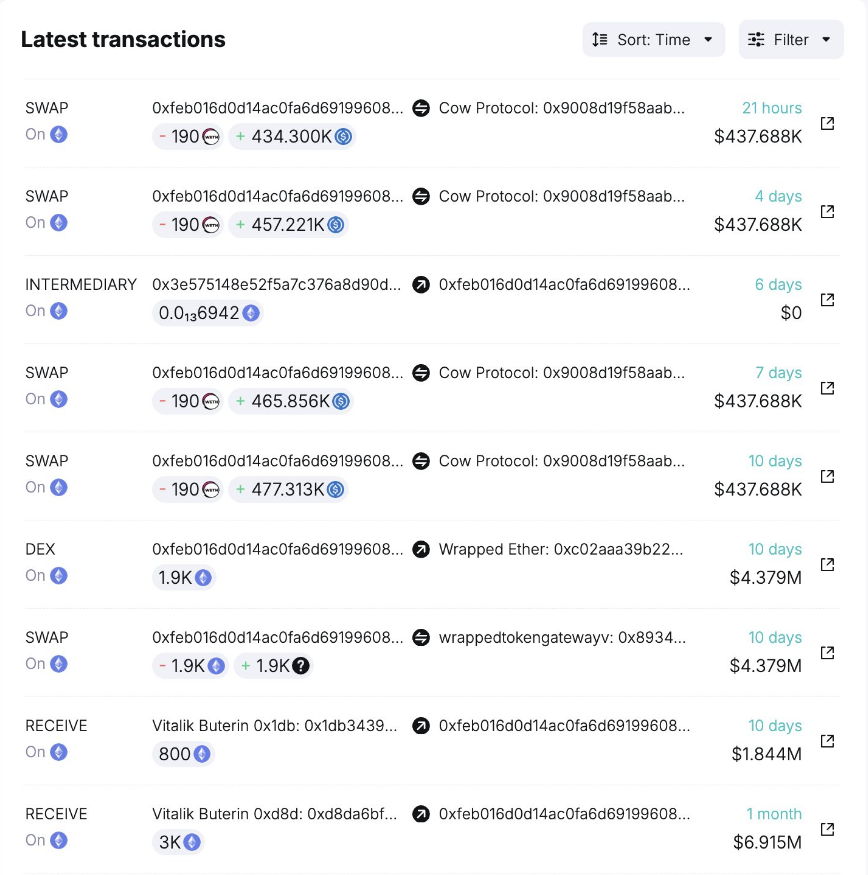

The pockets, in response to studies, has been promoting because it acquired Buterin’s ETH in two transactions on Aug. 9 and Aug. 30 totaling 3,800 ETH. Within the wake of the 2 transfers, the pockets has bought 760 ETH for roughly 1.835 million USDC or roughly $2,414 per ETH.

The multi-signature pockets that obtained $ETH from @VitalikButerin is on a promoting streak!

After receiving 3,800 $ETH ($9.99M) from Vitalik on Aug 9 and 30, it’s been cashing out, promoting 760 $ETH for 1.835M $USDC at ~$2,414 per ETH. The most recent sale occurred simply 21 hours in the past.… pic.twitter.com/ELcjpPSg4K

— Spot On Chain (@spotonchain) September 9, 2024

The current sale was made simply 21 hours in the past and has develop into part of a streak of aggressive liquidations which have sparked speculations within the crypto group.

Buterin was even accused of “dumping” his ETH holdings, which he all the time publicly denied, claiming that funds go to help growth within the Ethereum ecosystem and philanthropy. Whereas he has been reassuring, the continual gross sales from wallets attributed to him have significantly contributed to elevated bearish sentiment amongst traders.

Broader Market Implications

This promoting is just not a one-man exercise carried out by Buterin; Ethereum Basis can be infamous for offloading big portions of ETH. Based on studies, it has bought over 3,066 ETH this 12 months alone.

Such sustained gross sales have raised questions on the entire Ethereum market’s well being. Based on analysts, gross sales similar to these, along with giant holder retailer reductions, have made life powerful for ETH, struggling to carry its worth.

Apart from Buterin’s sell-offs, one of many largest Ethereum whales liquidated a complete of 28,554 ETH in money with a view to pay again his debt on Aave, a decentralized borrowing platform.

That quantity interprets into roughly $64.4 million. This additional added to the ETH sell-off stress, making issues much more sophisticated for ETH available in the market.

These cumulative actions have stirred talks that this aggressive ETH sell-off may trigger ETH to plunge even under $2,000 if it proceeds this fashion.

Associated Studying

A Name For Transparency

With the scenario nonetheless growing, there are some calling for extra transparency on Buterin’s half and that of the Ethereum Basis with respect to how they’re promoting the cryptocurrency.

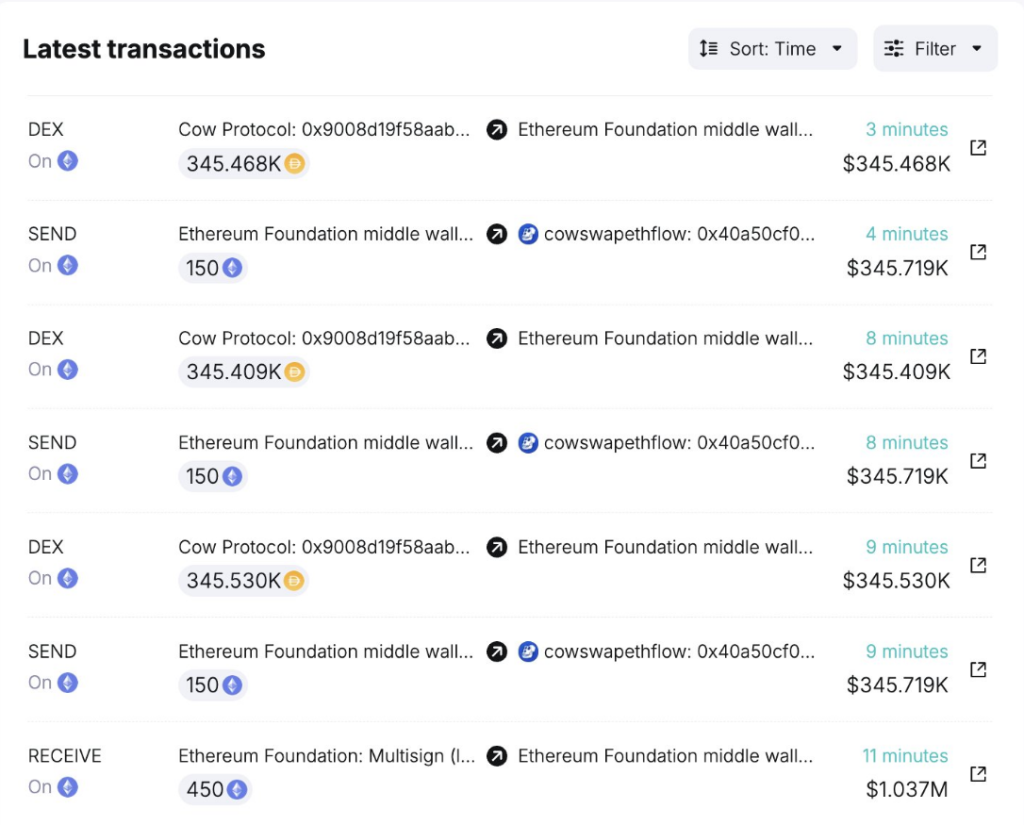

After Vitalik, the Ethereum Basis is the subsequent to promote $ETH!

Simply 10 minutes in the past, the #EthereumFoundation bought 450 $ETH for 1.029M $DAI.

In complete, they’ve bought 550 $ETH ($1.28M) at a median worth of $2,324 up to now 4 days.

Comply with @spotonchain for extra updates… https://t.co/d2bP0WLo9C pic.twitter.com/cjgFvMeOvw

— Spot On Chain (@spotonchain) September 9, 2024

Insiders near the muse have stated its gross sales are a part of a deliberate monetary coverage geared toward managing operational bills, together with grants and salaries.

Based on Aya Miyaguchi, govt director of the Ethereum Basis, one requirement is the necessity to convert parts of the ETH it holds into stablecoins like DAI to cowl sure monetary obligations.

This casts a shadow on the Ethereum group, as to the place this might lead in the long term. Although the concept of Buterin and the Basis might be genuinely legitimate, this dumping notion performs a big function in investor notion.

With this motion, the market would reply to such withdrawals, and restoration or fall in ETH worth is one thing the stakeholders keenly await.

Featured picture from Shrimpy Weblog, chart from TradingView