The Head of Analysis on the on-chain analytics agency CryptoQuant has defined why Bitcoin could also be susceptible to seeing an additional drawdown.

Bitcoin Is Nonetheless On Verge Of Bear Market In This Indicator

In a brand new put up on X, CryptoQuant Head of Analysis Julio Moreno has mentioned the most recent development within the Bitcoin Bull-Bear Market Cycle Indicator. The “Bull-Bear Market Cycle Indicator” from CryptoQuant is an indicator based mostly on the P&L Index.

The P&L Index combines just a few widespread BTC metrics associated to revenue and loss, so it sums up the market steadiness in a single worth. This indicator can confirm whether or not the asset goes via a bullish or bearish interval by evaluating it towards its 365-day shifting common (MA).

When the cryptocurrency breaks above its 365-day MA, it may be assumed to be inside a bull market. Equally, falling beneath this MA implies a transition towards a bear market.

The Bull-Bear Market Cycle Indicator, the precise metric of focus right here, exists to make this sample simpler to observe; it retains observe of the space between the P&L Index and its 365-day MA.

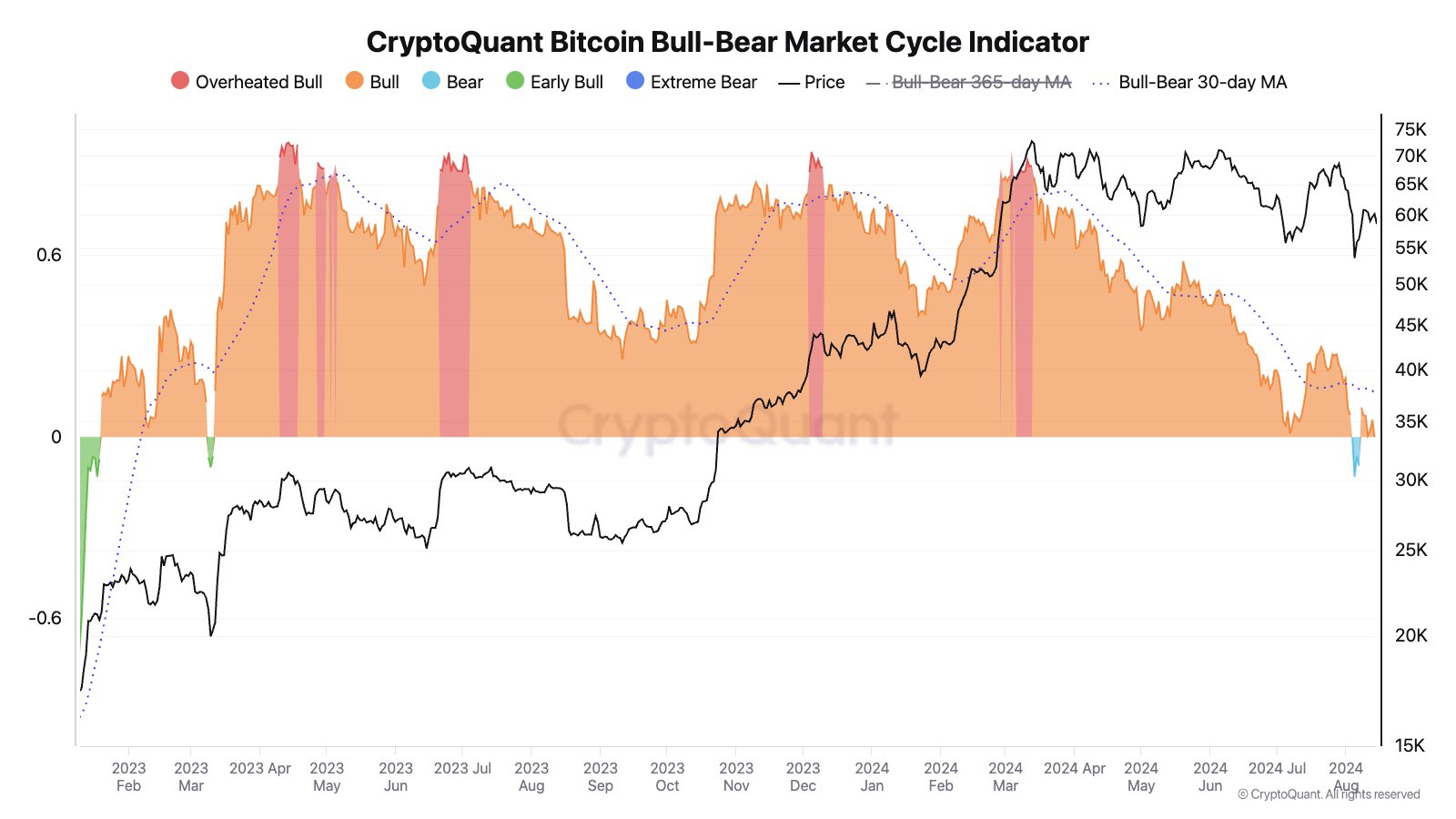

Now, here’s a chart that reveals the development within the Bitcoin Bull-Bear Market Cycle Indicator over the previous couple of years:

As displayed within the above graph, the Bitcoin Bull-Bear Market Cycle indicator had reached excessive values in the course of the worth all-time excessive (ATH) earlier within the yr (coloured in crimson).

At these ranges, the P&L Index has fairly the hole over its 365-day MA, so the cryptocurrency’s bull rally has grow to be overheated. The graph reveals that the metric additionally gave this sign on just a few different events in the course of the previous two years, and every time, the asset’s worth reached the highest.

Nevertheless, these earlier tops weren’t sufficient to carry the market again in the long run, because the Bull-Bear Market Cycle Indicator continued to keep up contained in the bull territory (shaded in orange), the place the P&L Index is above its 365-day MA.

Nevertheless, bull market momentum has lastly proven indicators of operating out, with the indicator even briefly plunging into the bear territory (gentle blue) in the course of the latest worth crash.

Whereas the metric has recovered again into the bull area with the surge that BTC’s worth has noticed, it’s nonetheless very near the impartial mark, which means it may well probably sink again into the bearish zone shortly. Primarily based on this development, Moreno notes that BTC might nonetheless danger seeing an additional correction.

BTC Value

Bitcoin has seen its restoration stall not too long ago, as its worth remains to be buying and selling across the $58,500 mark.