Ethereum is trying to regain stability after the sharp selloff on Tuesday that despatched its value plunging under $3,100. The drop triggered widespread liquidations throughout the crypto market, with ETH briefly touching multi-week lows earlier than discovering help. As of at the moment, bulls are attempting to reclaim the $3,350 stage, a short-term resistance zone that would decide whether or not the asset levels a broader restoration or faces one other leg down.

Associated Studying

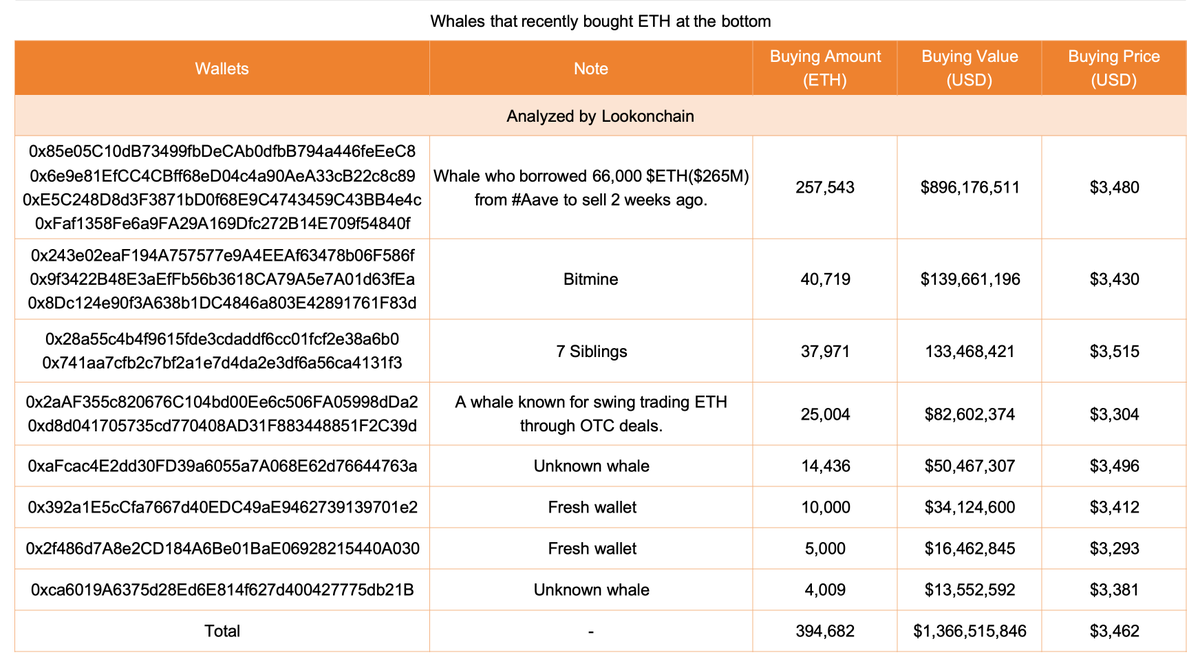

Regardless of the volatility, on-chain knowledge reveals a special story beneath the floor. Giant traders — also known as whales — have continued to build up ETH, signaling long-term confidence within the community’s fundamentals. Their regular shopping for exercise stands in stark distinction to the broader market’s fear-driven habits, suggesting that main holders view the latest correction as a shopping for alternative reasonably than a reversal.

Traditionally, whale accumulation throughout deep pullbacks has typically preceded robust rebounds, as institutional and long-term capital step in whereas retail sentiment weakens. The problem now lies in whether or not Ethereum can keep momentum above key technical ranges, particularly as general market confidence stays fragile. If shopping for stress continues to construct, ETH may discover the muse for a sustained restoration heading into mid-November.

Whales Accumulate ETH, Hinting at Impulsive Transfer Forward

In keeping with Lookonchain, Ethereum whales have collectively amassed 394,682 ETH, price roughly $1.37 billion, over the previous three days. This wave of large-scale shopping for comes as costs consolidate under $3,400, signaling that deep-pocketed traders are positioning forward of a possible market rebound.

Such aggressive accumulation typically signifies sensible cash confidence in future upside potential. Traditionally, when whales purchase during times of widespread worry and weak value motion, it suggests they’re anticipating an impulsive part — a pointy transfer pushed by renewed liquidity and market sentiment restoration. The size and velocity of this accumulation reinforce the concept these entities count on Ethereum to outperform as soon as promoting stress fades.

This development additionally aligns with broader market habits seen after main liquidations, the place institutional gamers have a tendency to soak up provide from shaken-out merchants. If ETH holds above its key help round $3,100, the mix of whale accumulation, enhancing on-chain inflows, and decreased leverage may act because the catalyst for a breakout towards the $3,600–$3,800 vary.

Associated Studying

ETH Finds Assist at 200-Day MA

Ethereum’s day by day chart exhibits that the asset has discovered momentary reduction after Tuesday’s sharp selloff, which dragged costs under $3,100 for the primary time in weeks. The decline introduced ETH down to check its 200-day shifting common (pink line) — a key long-term dynamic help that traditionally acts as a springboard throughout corrective phases.

At present, Ethereum is buying and selling round $3,380, displaying indicators of a modest rebound. Nevertheless, bulls face quick resistance close to the $3,500–$3,600 vary, the place the 50-day (blue) and 100-day (inexperienced) shifting averages converge. This space has repeatedly rejected upward strikes since late October and can probably outline short-term course.

Associated Studying

A decisive break above these averages may shift momentum again in favor of the bulls, opening the door for a restoration towards $3,800. On the draw back, a failure to carry above the 200-day MA might set off additional weak spot towards $3,000 and even $2,850, the place earlier demand zones exist.

Featured picture from ChatGPT, chart from TradingView.com