Ethereum has lastly touched the $3,000 value degree as soon as once more after spending weeks buying and selling in a slim vary beneath $2,800. This current breakout, though transient, marks the primary time Ethereum reclaimed this degree since early February. In accordance with technical analyst Merlijn The Dealer, Ethereum’s subsequent vacation spot after breaking previous $3,000 is already in sight.

Associated Studying

Bull Flag Breakout Factors To Measured Transfer For Ethereum

Ethereum went by means of an attention-grabbing rally final week alongside Bitcoin’s push to new all-time highs. Nonetheless, this Ethereum value rally, which noticed it contact $3,000 once more, wasn’t primarily based on momentum spillover from Bitcoin alone. It is because Ethereum itself skilled vital institutional curiosity from Spot Ethereum ETFs.

In accordance with knowledge from SoSoValue, US-based Spot Ethereum ETFs recorded a mixed $907.99 million in inflows final week, their finest week because the merchandise launched in July 2024. Thursday, July 10, alone was highlighted by inflows of $383.10 million, making it the most important single-day influx for any Ethereum ETF in 2025 thus far.

In a submit shared on the social media platform X, crypto analyst Merlijn pointed to a confirmed bull flag breakout on Ethereum’s every day candlestick timeframe chart. Apparently, the technical setup proposed by the analyst follows a falling wedge reversal that preceded the present uptrend.

In accordance with the chart hooked up to his evaluation, the falling wedge that led to the reversal was fashioned from the December 2024 highs to the April 2025 lows, with the breakout occurring in mid-Might. The breakout ultimately noticed Ethereum coming into into a decent flag-like consolidation that spanned between Might and June, till the latest breakout above $2,700.

That sample has now resolved to the upside, and the following technical degree of curiosity is a measured transfer primarily based on the worth motion that fashioned the pole of the bull flag. This measured transfer locations the following technical degree of value curiosity at $3,834.

Picture From X: Merlijn The Dealer

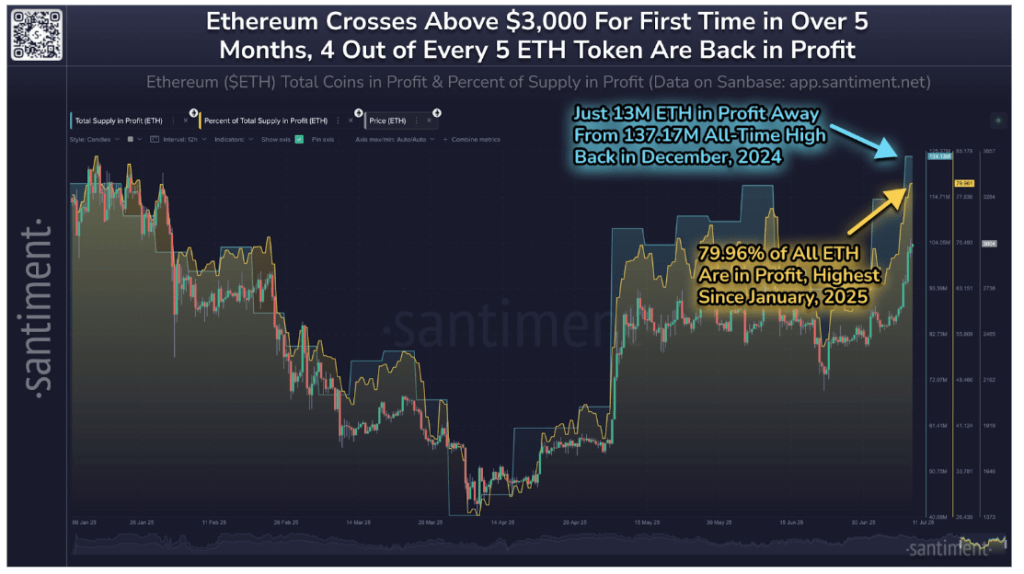

80% Of ETH Now In Revenue

On-chain indicators additional validate Ethereum’s present energy. In accordance with knowledge from on-chain analytics platform Santiment, Ethereum’s value motion has been dancing across the $3,000 mark since Friday, crossing it a number of occasions intraday. Throughout this forwards and backwards, 124.13 million ETH out of the 155.04 million whole provide crossed into profitability, which represents 79.96% of all tokens. This studying is especially attention-grabbing as it’s the highest share recorded since January 2025.

Picture From X: Santiment

The identical knowledge reveals Ethereum is simply 13 million cash away from matching the whole provide in revenue at its earlier all-time excessive of profitability recorded in December 2024. This shift towards a profit-heavy community state tends to encourage holding conduct and long-term conviction, which may translate into decreased promote strain within the coming week. This, in flip, may see Ethereum shut a every day candle above $3,000 and transfer towards the $3,834 value goal throughout the brand new week.

Associated Studying

On the time of writing, Ethereum is buying and selling at $2,960, up by 17.5% prior to now 24 hours.

Featured picture from Unsplash, chart from TradingView