Cambodia has detained and extradited Chen Zhi, the alleged operator of a sprawling “pig-butchering” and on-line fraud community, to China, creating a brand new query for crypto markets and legislation enforcement: what occurs to the Bitcoin nonetheless linked to him on-chain.

The arrest and handover have been introduced by Cambodian authorities this week after what officers described as months of joint investigative cooperation with Beijing. Chen’s Cambodian citizenship had been revoked by royal decree in December 2025, in accordance with reporting from regional and worldwide shops.

Reuters reported on Tuesday that Cambodia extradited three Chinese language nationals: Chen Zhi, Xu Ji Liang, and Shao Ji Hui, and that officers didn’t present particulars of the underlying allegations of their public assertion.

Bitcoin Windfall For China?

For Bitcoin, the fast hook is the scale and obvious stasis of the remaining BTC footprint that Galaxy Digital’s head of firmwide analysis Alex Thorn says could be traced to Chen’s orbit. In a collection of posts on X, Thorn highlighted that US authorities beforehand seized 127,000 BTC linked to the group, info that was unsealed in October 2025, however that Chen “nonetheless has greater than $2bn in BTC.”

pig-butchering rip-off king Chen Zhi arrested in Cambodia, extradited to China. the US beforehand seized 127k BTC from wallets related to this group (information unsealed in october 2025)

however zhi nonetheless has greater than $2bn in BTC. that’s a pleasant pile of corn for the chinese language pic.twitter.com/jPQaflER8i

— Alex Thorn (@intangiblecoins) January 7, 2026

Thorn added: “we recognized 23,191 BTC related to him,” cut up between 7,234 BTC nonetheless sitting in wallets tagged to Prince Group/LuBian and 15,957 BTC that, he stated, was moved out of OFAC-sanctioned wallets into new addresses shortly after the October unsealing.

Thorn framed the jurisdictional dilemma bluntly. “The US has an indictment for him however now that China is holding him there’s no approach the US will seize him,” he wrote. “Stays to be seen what occurs with these 23k BTC we’ve recognized. None of it has moved since he was arrested or extradited.”

Thorn additionally pointed again to a element that has lingered over the US forfeiture: the “Milk Unhappy” weak-entropy subject tied to LuBian wallets, which created a long-running concept that the 2020 compromise of a significant mining pockets cluster was much less simple than it appeared.

A Galaxy Analysis transient printed in October described the DOJ’s motion as its “largest-ever asset forfeiture,” saying US authorities seized 127,271 bitcoin and centered the case on Chen, whom prosecutors accused of working a “vertically built-in felony conglomerate” spanning on-line playing, forced-labor compounds, and pig-butchering scams.

The transient argued that the court docket paperwork listed pockets addresses that matched “1-for-1” a set of weak-entropy LuBian wallets recognized by cybersecurity researchers, however that these wallets “had almost zero bitcoin in them on the time of seizure,” with the seized BTC coming “nearly solely from wallets related to the Lubian.com exploiter.”

That historical past issues as a result of it reframes the open query across the 23,191 BTC Thorn says stays identifiable as we speak. If Thorn’s monitoring is true, the following transfer is about which jurisdiction, if any, can really attain the cash.

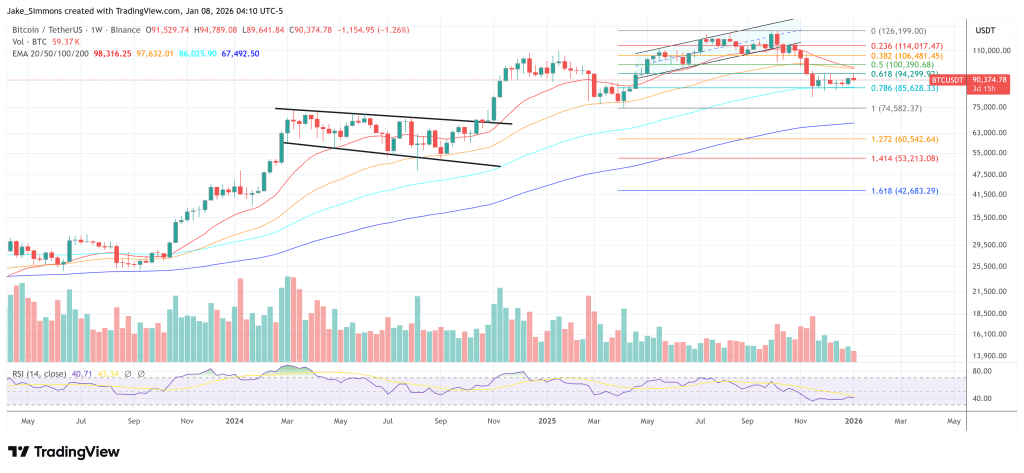

At press time, BTC traded at $90,374.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.