The crypto market stays beneath intense promoting strain, with sentiment turning more and more bearish as Bitcoin trades beneath the $100,000 mark for the primary time since Could. Altcoins have fared even worse, extending a downtrend that started in early October. Regardless of this wave of uncertainty and fading bullish momentum, capital inflows into the market proceed to develop — suggesting that traders could also be making ready for the subsequent section of accumulation.

Associated Studying

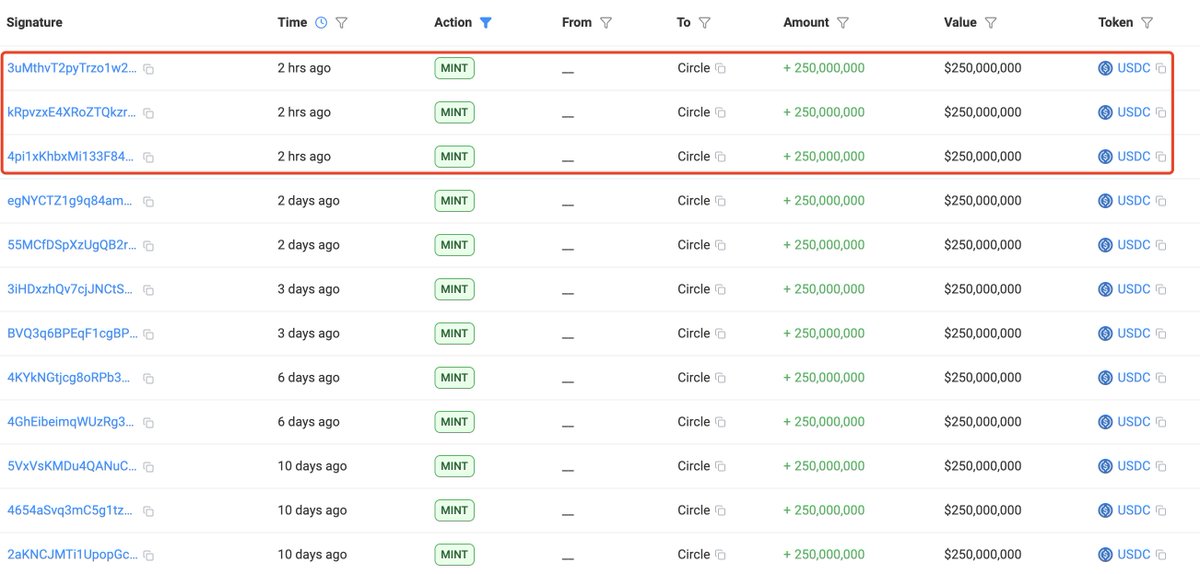

Lookonchain studies that stablecoin issuance has surged in latest weeks, led by giants like Tether (USDT) and Circle (USDC). Collectively, the 2 companies have minted over $14 billion in new stablecoins because the October 10 market crash.

This rising stablecoin provide typically acts as a number one indicator of contemporary capital ready to be deployed. Traditionally, related surges in stablecoin minting have preceded market rebounds, as merchants and establishments place themselves to purchase during times of weak point.

Circle’s USDC Mint Extends Liquidity Wave Amid Bearish Sentiment

In accordance with information shared by Lookonchain, Circle has simply minted one other $750 million in USDC, including to the wave of stablecoin inflows seen throughout the market in latest weeks. This continues the broader development of renewed liquidity coming into the crypto ecosystem, with each Circle and Tether minting a mixed $14 billion because the early October crash. Such exercise typically alerts that capital is being parked on the sidelines, able to be deployed into danger belongings as soon as confidence improves.

Nevertheless, regardless of this rise in liquidity, market sentiment stays extremely fearful. Many merchants and analysts warn that the persistent promoting strain and failure to carry key psychological ranges — notably Bitcoin’s fall beneath $100,000 — might mark the start of a broader bearish section. The divergence between liquidity inflows and market efficiency displays a fancy surroundings the place capital accumulation just isn’t but translating into shopping for momentum.

In different phrases, whereas the stablecoin provide acts because the dry powder wanted for a possible rebound, concern continues to dominate buying and selling conduct. Whether or not this latest USDC minting fuels a restoration or just cushions additional draw back will depend upon how macro circumstances evolve and whether or not institutional demand reemerges to soak up the present provide overhang.

Associated Studying

USDC Dominance Climbs as Buyers Search Stability Amid Market Worry

The chart reveals USDC dominance rising steadily since mid-2024, now hovering round 2.33%, its highest degree in almost a yr. This uptrend alerts a rising desire for stability amongst crypto traders amid intensifying market volatility and declining danger urge for food. As Bitcoin trades beneath $100,000 and altcoins proceed to bleed, many merchants are rotating their holdings into stablecoins like USDC to protect capital.

From a technical perspective, USDC dominance has damaged above its 50-day and 100-day shifting averages, indicating a shift in momentum towards capital preservation. Traditionally, such climbs in stablecoin dominance happen throughout correction or consolidation phases, when liquidity exits speculative belongings and strikes into safer reserves.

Associated Studying

The latest $750 million USDC mint by Circle, coupled with rising on-chain stablecoin balances, reinforces this defensive market posture. Whereas this inflow boosts out there liquidity, it additionally displays widespread warning — traders are holding fireplace, ready for clearer alerts earlier than reentering danger belongings.

If USDC dominance continues to climb, it might recommend additional draw back strain throughout the crypto market. Nevertheless, as soon as dominance plateaus or declines, it might mark the early phases of a market rotation — signaling that secure liquidity is making ready to move again into Bitcoin and altcoins.

Featured picture from ChatGPT, chart from TradingView.com